Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

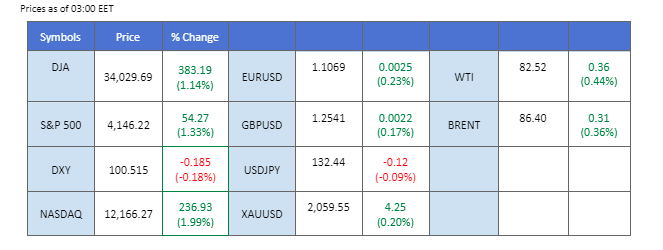

The US Federal Reserve’s rate hike expectations have continued to wane amid a flurry of lacklustre economic data. The latest blow to inflationary pressures came from the Producer Price Index (PPI) released by the Bureau of Labor Statistics, which displayed a significant drop in annualised price increases. The key inflation metric plummeted to its lowest level since January 2022, raising concerns among market participants about the sustainability of price pressures. In contrast, the US Initial Jobless Claims have escalated to worrying levels, underscoring the ongoing struggles facing the US economy. The weak economic data has led to a bearish sentiment towards the US Dollar, along with a slump in US Treasury yields, while the US equity market has displayed an impressive rally.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (36.1%) VS 25 bps (63.9%)

.webp)

The Dollar Index, which tracks the greenback’s performance against a basket of six major currencies, has tumbled to a two-month low following the release of the US Producer Price Index (PPI) data for March. The unexpected decline in producer prices has heightened expectations that the Federal Reserve (Fed) is nearing the end of its rate hike cycle. As investors await the next major US economic release, the retail sales report on Friday, analysts are eager to analyse how inflation affects consumer spending.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 25, suggesting the index might enter oversold territory.

Resistance level: 101.45, 102.70

Support level: 100.85, 100.15

Gold prices continue to climb higher, bolstered by a pessimistic economic outlook in the US that has dampened market optimism for global economic growth. The shift in sentiment towards safe-haven assets has led to significant bullish momentum for gold. The recent Producer Price Index (PPI) released by the Bureau of Labor Statistics, revealed a sharp decline in annualised inflation to its lowest level since January 2021. In contrast, the US Initial Jobless Claims have climbed to a concerning level, indicating the country’s economic progression remains bleak.

Gold prices are trading higher while currently near the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 62, suggesting the commodity might enter overbought territory.

Resistance level: 2040.00, 2055.00

Support level: 2030.00, 2020.00

The euro rose 0.7% against the dollar following the release of U.S. producer prices and weekly jobless claims data, which suggested that the Federal Reserve may pause their interest rate hikes to control inflation. Furthermore, European investors are increasingly predicting that the European Central Bank will need to maintain a longer period of rate hikes to curb rising inflationary pressures, according to recent market data. The increasing expectation on ECB’s rate hike path further boosted the euro.

The pair has successfully spiked above its psychological resistance level of $1.1000 and is currently trading at $1.1060. MACD is indicating an increasing bullish momentum ahead. RSI is at 74, reaching the overbought zone. It might have a technical correction very soon.

Resistance level: 1.1138, 1.1194

Support level: 1.1034, 1.0965

The USD/CHF currency pair plunged to its lowest level in 27 months, amid a broader decline in the US Dollar against major currencies. The downward trend in the greenback comes as the market takes a cautious approach, ahead of key Swiss inflation figures. The recent release of disappointing US inflation data has further weighed on the US Dollar, signalling that there may not be a need for higher interest rates from the Federal Reserve.

USD/CHF is trading lower while currently testing the support level. MACD has illustrated bearish momentum. However, RSI is at 29, suggesting the pair might enter oversold territory.

Resistance level: 0.9125, 0.9420

Support level: 0.8865, 0.8555

Sterling climbed to its highest level since last June on Thursday, shrugging off weak UK economic data. The pound was bolstered as the dollar dipped to a two-month low following a slowdown in US inflation. However, data released on Thursday showed that the UK economy saw no growth in February, as strikes from public workers impacted output. Despite this, an upward revision to January’s growth figures has eased concerns about a possible recession in early 2023. The currency market remained primarily focused on the US dollar’s performance, and investors continue to monitor next week’s UK inflation, retail sales, and job data, which will be crucial for monetary policy.

MACD rebounded on the zero line, indicating a bullish momentum continues. RSI is at 65, suggesting a bullish momentum as well. Please be cautious, as technical analysis has shown some peaks. It might have a slight retracement ahead. Investors are advised to exercise caution and closely monitor market developments to make the most informed decisions possible.

Resistance level: 1.2613, 1.2740

Support level: 1.2425, 1.2298

The US equity market witnessed a remarkable surge, as investors reacted to the latest economic data. The cooling inflation and loosening labour market had sparked expectations that the Federal Reserve could be moving towards the end of its aggressive interest rate hike cycle. According to the Bureau of labour statistics, the Producer Price Index (PPI) revealed a substantial decline in annualised price increases, with the crucial inflation gauge hitting its lowest level since January 2021. The Dow Jones Industrial Average, which rose by 1.1%, or 383 points, marking a significant rebound for the benchmark index.

The Dow is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 67, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 34310.00, 35770.00

Support level: 32875.00, 31600.00

Crude oil prices pulled back slightly from a crucial resistance level as traders took profit but remained elevated near a five-month peak amid a tightening global market. OPEC’s latest monthly report warns of potential challenges to summer oil demand due to rising inventories and obstacles to global economic expansion. The report highlights downside risks to the oil market amid ongoing uncertainty in the pandemic recovery. Despite efforts to manage supply and stabilize prices, the market remains vulnerable to volatility, with investors keeping a close watch on the situation.

Oil prices retreated as traders took profits after the market hit a five-month high. However, technical indicators suggest that the overall momentum remains neutral-bullish. MACD has illustrated neutral-bullish momentum ahead. RSI is at 58, indicating that oil prices are still bullish. Investors closely monitor the market as ongoing supply-demand dynamics and economic recovery efforts influence oil prices.

Resistance level: 85.45, 90.04

Support level: 81.06, 77.25

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!