Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

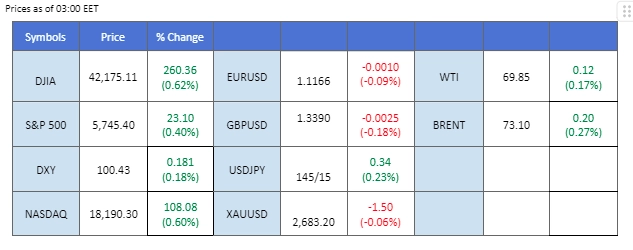

Market Summary

The Chinese equity market has emerged as the standout asset class in the financial world, with the China A50 index posting its largest weekly gain in a decade and the Hang Seng Index (HK50) rising by over 12% this week. The market rally has been driven by ongoing economic stimulus measures from the Chinese government, which have bolstered confidence and spread momentum to global markets, including Wall Street, where stocks extended their bullish rally in the last session.

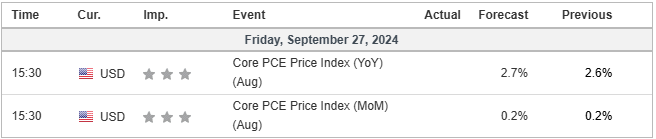

In the U.S., GDP data released yesterday met market expectations, while a rise in continuous jobless claims points to further softening in the labour market, increasing the likelihood of a larger Fed rate cut in the near term. Today’s focus is on the U.S. PCE reading and Fed Chair Jerome Powell’s speech, which are expected to provide fresh insights on the strength of the U.S. dollar.

In the commodity market, gold is nearing its next psychological resistance at $2,700, while oil prices remain under pressure amid expectations of increased supply from producers like Saudi Arabia and Libya.

In the crypto market, Bitcoin (BTC) has broken above its previous high, buoyed by improved risk appetite. The crypto fear and greed index has surged to its highest level since early August, signalling heightened optimism in the market.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32%) VS -25 bps (68%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the US dollar against a basket of six major currencies, rebounded following better-than-expected US economic reports. The US Gross Domestic Product (GDP) surged from the previous reading of 1.6% to 3.0%, in line with market expectations. Additionally, Durable Goods Orders and Initial Jobless Claims both exceeded forecasts, with Durable Goods posting -2.8% and Jobless Claims registering at 224K. These stronger-than-anticipated reports supported the dollar’s upward trajectory. However, uncertainties remain as investors look ahead to the US Core PCE Price Index, a key inflation gauge, which could influence the dollar’s direction.

The Dollar Index is trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the index might experience technical correction since the RSI stays below the midline.

Resistance level: 101.80, 102.35

Support level: 100.45, 99.70

Gold prices experienced significant volatility, initially surging after breaking through a key resistance level. However, the rally was short-lived as better-than-expected US economic data prompted a dollar rebound, which in turn pressured gold prices downward. As the market moves forward, investors are focusing on the US Core PCE Price Index to assess the future trajectory of gold.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 52, suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 2700.00, 2740.00

Support level: 2665.00, 2640.00

The Pound Sterling has formed a double-top price pattern, signalling potential resistance and a slowdown in its recent bullish momentum. This is further supported by weakening momentum indicators, suggesting that the pair may face downward pressure soon. Meanwhile, the U.S. dollar is struggling after disappointing job data, with continuous jobless claims rising, indicating a softening labour market. This has cast doubt on the dollar’s recent strength. The market’s attention has now shifted to the upcoming U.S. PCE reading, which could provide crucial insights into inflation and directly impact the dollar’s strength. A softer-than-expected PCE reading could further weigh on the dollar.

The GBP/USD pair was rejected at its recent high level of 1.3430, suggesting a potential trend reversal signal. Should the pair fail to support above its previous low of 1.3315, it may suggest a bearish signal. The RSI remains close to the overbought zone while the MACD edges lower, suggesting the bullish momentum is easing.

Resistance level: 1.3350, 1.3440

Support level:1.3285, 1.3220

The EUR/USD pair continues to trade within its uptrend channel but has struggled to reach its previous high, indicating a potential trend reversal. Despite the dollar facing downside pressure, the dovish stance from the ECB has offset some of the dollar’s weakness. Several ECB board members have expressed concerns about potential economic stagnation in the Eurozone, advocating for a more cautious and dovish approach to monetary policy. This shift could weigh on the euro’s strength, as a more accommodative policy stance may diminish the currency’s appeal, adding downside risks to the pair.

A potential head-and-shoulders price pattern forms as the pair fails to reach its previous high in the last session. The RSI remains above the 50 level, but the MACD has been flowing lower and has formed a bearish divergence, suggesting a potential trend reversal for the pair.

Resistance level: 1.1220, 1.1300

Support level: 1.1150, 1.1080

The USD/JPY pair has broken above its short-term resistance level at 144.30, signalling a potential bullish trend. However, this momentum was disrupted by the release of Japan’s CPI, which met market expectations. The in-line inflation data has fueled speculation of a possible rate hike from the BoJ in December, bolstering the Japanese yen and tempering the pair’s upward movement. The anticipation of tighter monetary policy from the Bank of Japan has strengthened the yen, adding downside pressure to the pair’s bullish outlook.

The USD/JPY pair remains trading with its uptrend trajectory despite recording a marginal technical correction at its weekly high level. The RSI remains at the above 50 level, while the MACD hovers above the zero line, suggesting the pair remains trading with bullish momentum.

Resistance level: 146.00, 149.20

Support level: 141.40, 138.90

Artificial intelligence giant Nvidia (NASDAQ: NVDA) saw its stock rise by 2%, extending Tuesday’s gains after reports indicated that CEO Jensen Huang had completed selling over $700 million worth of shares under a trading plan. Meta Platforms Inc (NASDAQ: META) also climbed 0.9% after unveiling its first augmented reality glasses and announcing several AI feature updates at its annual Connect event. The broader positive trend in the equity market is largely driven by the decline in US Treasury yields.

NASDAQ is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 20015.00, 20705.00

Support level: 18860.00, 18320.00

Oil prices fell for the third consecutive day, on track to close the week lower. Investors focused on the expectation of increased supply from Libya and the broader OPEC+ group. Rival factions in Libya signed an agreement to resolve their dispute over control of the Central Bank, a key factor in the sharp reduction of the country’s oil production and exports. Libyan crude exports, which had fallen to 400,000 barrels per day (bpd) from over 1 million bpd, could recover by more than 500,000 bpd, according to ANZ Bank analyst Daniel Hynes. Additionally, OPEC+ is currently cutting oil output by 5.86 million bpd, but plans to reverse 180,000 bpd of those cuts in December.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bullish momentum, while RSI is at 37, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 68.60, 70.30

Support level: 67.15, 65.60

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!