Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

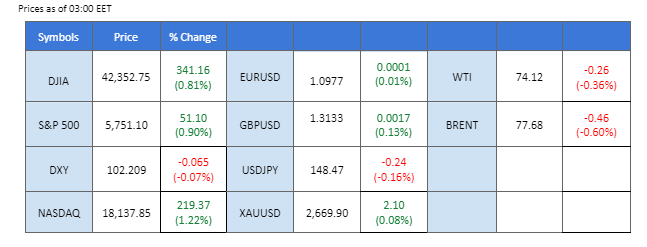

Market Summary

The Dollar Index surged to a seven-week high, driven by strong U.S. economic data, with Nonfarm Payrolls hitting 254,000 and the Unemployment Rate dropping to 4.1%. This data diminished expectations for a 50-basis-point rate cut, bolstering the dollar but weighing on gold as the stronger dollar overshadowed the metal’s safe-haven appeal.

Oil prices posted their best weekly gains in over a year amid heightened Middle East tensions, with Brent and WTI up over 8% and 9.1%, respectively. The risk of regional conflict has raised supply concerns, particularly around Iran’s significant oil output, adding volatility to the market.

The Japanese yen weakened considerably following comments from Japan’s new Prime Minister, Shigeru Ishiba, who indicated that the economy is not ready for further rate hikes. This dovish stance, combined with reduced expectations for aggressive U.S. rate cuts, has widened the yield differential between the U.S. and Japan, contributing to yen softness.

Moving forward, Investors will continue monitoring the U.S. CPI data and the Fed’s September meeting minutes this week, as these could influence market dynamics further.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index surged to a seven-week high, demonstrating strong bullish momentum amid a series of robust U.S. economic data releases. The Nonfarm Payrolls jumped to 254K, significantly above the expected 147K, while the Unemployment Rate improved to 4.1% versus an expected 4.2%. Average Hourly Earnings also exceeded expectations, rising by 0.4%. This data eliminated the likelihood of a 50-basis-point rate cut, with the CME Group’s FedWatch Tool showing a drastic shift in expectations from 31% earlier on Friday and 53% a week ago to no chance of a cut.

The Dollar Index has broken its previous high at $101.80, suggesting it is currently trading in extreme bullish momentum. The RSI has broken into the overbought zone, while the MACD continues to edge higher, suggesting the bullish momentum is gaining.

Resistance level:102.4, 103.30

Support level: 101.10, 100.30

Gold prices experienced volatility, with investors adopting a cautious approach amid mixed signals. While escalating tensions in the Middle East initially drove demand for gold as a safe-haven asset, the appeal was curtailed by the robust U.S. jobs report. The stronger dollar further weighed on gold, given its dollar-denominated nature. Looking ahead, investors will focus on Thursday’s U.S. CPI report, which could shape expectations on inflation and, in turn, impact gold prices. Additionally, the release of the Fed’s September meeting minutes on Wednesday will provide insight into future policy directions.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 47, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 2670.00, 2690.00

Support level: 2645.00, 2630.50

The Pound Sterling has experienced significant selling pressure recently, largely due to dovish remarks from the Bank of England. Chief Economist Huw Pill suggested on Friday that the BoE should adopt a gradual approach to rate cuts, which followed a 1% drop in the pound after Governor Andrew Bailey hinted at the potential for more aggressive rate reductions.

GBP/USD is trading flat while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.3205, 1.3315

Support level: 1.3065, 1.2940

The EUR/USD pair continues to face bearish momentum amid a strengthening U.S. Dollar. European Central Bank officials have issued cautious comments, with Vice President Luis de Guindos acknowledging downside risks to Eurozone growth, while Board Member Isabel Schnabel highlighted that achieving the ECB’s inflation target remains a challenge given ongoing economic headwinds.

EUR/USD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the pair might enter oversold territory.

Resistance level: 1.1015, 1.1080

Support level: 1.1950, 1.0890

The Japanese yen experienced a notable selloff following remarks from Japan’s new Prime Minister, Shigeru Ishiba, who indicated that Japan’s economy is not prepared for further rate hikes. This statement contrasted his earlier support for the Bank of Japan’s gradual unwinding of monetary stimulus, leading to increased selling pressure on the yen. Additionally, with diminished expectations for aggressive U.S. rate cuts, the narrowing yield differential between the U.S. and Japan has further contributed to yen weakness.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the pair might enter overbought territory.

Resistance level: 149.20, 151.75

Support level: 145.95, 143.45

U.S. equities remain resilient, supported by optimistic economic data. However, uncertainties persist as the third-quarter earnings season kicks off. This season will be a key test for the stock market, which is currently trading near record highs. Financial giants such as JPMorgan Chase, Wells Fargo, and BlackRock are set to report earnings this Friday, with their results offering insights into loan demand and potentially reflecting the impact of the recent significant Fed rate cut on consumer spending patterns.

Dow Jones is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 60, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from the midline.

Resistance level: 42420.00, 43440.00

Support level: 41400.00, 40135.00

The Hang Seng Index extended its gains, driven by strong bullish momentum within Chinese equities. Optimism remains high following signals of potential increased fiscal support from Beijing, with a leading economist suggesting up to 10 trillion yuan in special debt could be issued. Despite this optimism, concerns of a potential market bubble are emerging as benchmarks reach overbought levels, prompting a careful watch on the sustainability of this rally.

HK50 is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 86, suggesting the index might enter overbought territory.

Resistance level: 42420.00, 43440.00

Support level: 41400.00, 40135.00

Oil prices saw significant gains, posting their best weekly performance in over a year as the Middle East conflict raised fears of a region-wide war. Despite President Joe Biden urging Israel to refrain from targeting Iranian oil facilities, Brent crude rose over 8% and WTI gained 9.1% week-over-week. The escalating tensions underscore potential supply disruptions, with Iran’s contribution of around 3.2 million barrels per day to the global market being a major factor for investors to watch.

Oil prices are trading flat following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 62, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 76.85. 79.10

Support level: 73.80, 71.90

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!