Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

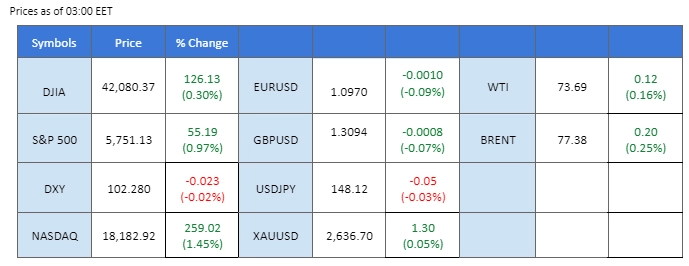

Market Summary

Chinese equities, including the China A50 and Hang Seng Index (HSI), extended their losses following the resumption of trading after the National Day holiday. Poor holiday economic data, combined with growing skepticism around stimulus measures, sparked a sell-off in the market, with the HSI plunging nearly 10% since its last session.

Meanwhile, U.S. markets were lifted by a tech rally, with Nvidia surging more than 4% in yesterday’s session. However, global equities face uncertainty amid escalating tensions in the Middle East and the Federal Reserve’s hawkish stance.

In the forex market, the dollar remains strong, with the Dollar Index hovering above the 102.00 mark. Strong U.S. jobs data and hawkish comments from Fed officials advocating caution on rate cuts have bolstered the greenback. Dollar traders are eyeing today’s FOMC meeting minutes and tomorrow’s U.S. CPI report for further direction.

In contrast, the Reserve Bank of New Zealand cut interest rates by 50 basis points, in line with market expectations, putting additional downside pressure on the Kiwi.

In commodities, gold faced heavy selling pressure, dropping to a two-week low. The prospect of a more hawkish Fed, which favours a stronger dollar, is weighing on gold prices. Oil prices also took a hit, driven by an unexpected 10.9 million-barrel build in U.S. crude inventories. Additionally, soft holiday data from China added to the negative sentiment surrounding oil prices.

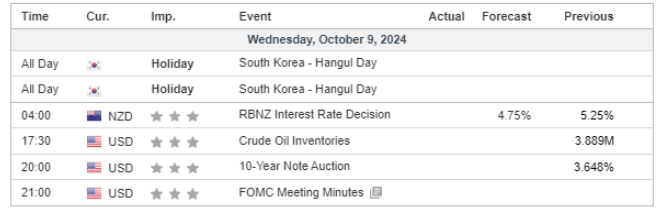

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index is holding near a strong resistance level as investors reassess the likelihood of further U.S. interest rate cuts. With recent U.S. data showing better-than-expected performance, expectations for aggressive rate cuts have diminished. Investors are now pricing an 87% chance of a 25-basis-point reduction at the Fed’s upcoming November meeting, and some are even betting on no cut at all. This week, key data releases, including the U.S. CPI report and the Fed’s September meeting minutes, are likely to influence market sentiment.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 102.55, 103.30

Support level: 101.80, 100.95

Gold prices (XAU/USD) have fallen for five consecutive days, reaching over a one-week low, breaking below 2630 support level. A strong U.S. labor market, as evidenced by last Friday’s upbeat Nonfarm Payrolls report, has led investors to scale back expectations for oversized rate cuts by the Fed. Additionally, a technical breakdown below a consolidation zone has accelerated the bearish momentum for gold. Investors will be closely monitoring the U.S. CPI, PPI reports, and the Fed’s upcoming meeting minutes for further clues on gold’s movement.

Gold prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 39, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 2630.00, 2640.00

Support level: 2605.00, 2590.00

The Pound Sterling remained range-bound against the dollar after experiencing a sharp decline at the start of the month. The dollar maintained its strength as Federal Reserve officials continued to signal a hawkish stance ahead of the FOMC meeting minutes release today and the U.S. CPI report tomorrow. Should the minutes reinforce a hawkish outlook, it could further boost the dollar, potentially driving the GBP/USD pair lower.

GBP/USD has eased from its bearish momentum and has been consolidating for the past few sessions, suggesting a potential technical rebound for the pair. The RSI has gotten out from the oversold zone, while the MACD has a golden cross at the bottom, suggesting the bearish momentum has eased.

Resistance level: 1.3140, 1.3220

Support level: 1.3065, 1.2940

The EUR/USD pair remains under pressure as the U.S. dollar strengthens, supported by recent robust economic data and the hawkish outlook from the Federal Reserve. The upcoming European Central Bank (ECB) interest rate decision, scheduled for next week, is anticipated to bring a rate cut as inflation targets are met and regional employment data disappoints. This expectation has weighed on the euro, causing it to trade weakly against its peers.

EUR/USD is struggling at its recent low level near 1.0960, a break below this level suggesting a bearish signal for the pair. The RSI remains below 50, while the MACD edges marginally higher at below the zero line, suggesting the pair remains trading with bearish momentum.

Resistance level: 1.1020, 1.1080

Support level: 1.1950, 1.0890

The New Zealand dollar (Kiwi) weakened following the Reserve Bank of New Zealand’s interest rate decision during the Sydney session. The central bank’s decision to cut rates by 50 basis points, in line with market expectations, sent the Kiwi to its lowest level in two months against the U.S. dollar, further dampening its strength.

The pair has declined by nearly 4% since the beginning of the month, suggesting a bearish signal. The RSI remains close to the oversold zone, while the MACD remains at the bottom, suggesting that the bearish momentum remains strong.

Resistance level: 0.6160, 0.6240

Support level: 0.6000, 0.5915

U.S. equities have seen a sharp retreat, weighed down by rising Treasury yields. The 10-year yield is back above 4% for the first time since August, as hopes for a significant rate cut diminish following robust employment data. With the third-quarter earnings season about to kick off, major banks like JPMorgan Chase, Wells Fargo, and Bank of New York Mellon are set to release earnings, which may provide insights into the economic outlook.

Dow Jones is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 55, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 42420.00, 43440.00

Support level: 41400.00, 40135.00

Oil prices extended losses on Tuesday, driven by news of a potential ceasefire deal between Hezbollah and Israel. However, fears of potential attacks on Iranian oil infrastructure provided some support. U.S. Vice President Kamala Harris remarked that while there has been progress on a Gaza ceasefire, it remains “meaningless” without a formal agreement. Additionally, bearish pressure on oil intensified after the American Petroleum Institute (API) reported a substantial increase in U.S. crude oil stocks, with a build of 10.9 million barrels, significantly above the expected 1.95 million barrels.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 49, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 74.85, 77.00

Support level: 72.65, 70.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!