Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

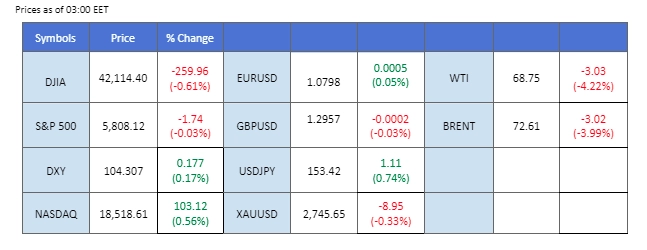

Market Summary

Japan’s political landscape took centre stage this week after the Prime Minister called a snap election, following the ruling party’s loss of its parliamentary majority. This political uncertainty has led markets to believe the Bank of Japan may delay its next rate hike, causing the Yen to soften to a three-month low. Meanwhile, the Nikkei surged by over 1% during the Tokyo session, buoyed by the shift in market sentiment.

In the U.S. equity markets, investors are focused on the tech sector as major companies, including Microsoft, Meta Platforms, and Apple, are set to release their earnings this week, which could inject volatility into market prices.

In commodities, gold held firm above the $2,730 mark, though facing pressure from a strong dollar. Oil prices, however, saw a sharp decline after Iran reported its oil facilities were operating normally despite recent Israeli military strikes on targets across the country. This update eased supply concerns, prompting a retreat in prices.

In the forex market, The Australian dollar continues to weaken, reaching its lowest level against the U.S. dollar since August. The Aussie faces ongoing downward pressure as traders anticipate the upcoming Australian CPI reading, due this Wednesday. Market expectations point toward a further easing in inflation, which could weigh on the Australian dollar’s strength if confirmed. Traders are advised to closely monitor this data release, as softer inflation figures may intensify the Aussie’s recent slide.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (97%)

-50 bps (7%) VS -25 bps (97%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

Market Movements

DOLLAR_INDX, H4

The Dollar Index held steady last week, continuing a positive trajectory as investors evaluated strong US economic data while awaiting key data releases this week. The dollar’s bullish trend has been primarily supported by a 40-basis-point rise in the 10-year Treasury yield for October, with the dollar climbing 3.60%—marking its sharpest monthly increase since April 2022. However, as the US presidential election and the Federal Reserve’s November policy meeting draw closer, market volatility may persist. Investors are advised to monitor these developments and upcoming reports on US Nonfarm Payrolls and unemployment, as these figures could significantly impact the dollar’s movement.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 65, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 104.95, 105.55

Support level: 103.95, 103.45

Gold prices continue a bullish path amid geopolitical tensions and looming global uncertainties. Investor sentiment has been bolstered by the approaching US election, alongside upcoming economic data releases, including US Nonfarm Payrolls, Core PCE Price Index, and GDP figures. Meanwhile, uncertainty surrounding Japan’s economic direction post-election is also pushing demand for safe-haven assets. Investors should remain vigilant about these events, as they are likely to drive heightened volatility and sustained interest in gold as a haven.

Gold prices are trading flat while currently testing the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 50, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2750.00, 2770.00

Support level: 2735.00, 2707.30

The GBP/USD pair is shaping an inverted Head-and-Shoulders pattern at its lowest point in over 10 weeks, indicating a potential trend reversal if it breaks above the 1.3030 resistance level. However, the U.S. dollar remains strong as anticipation builds ahead of next week’s U.S. presidential election. Traders should watch this week’s U.S. GDP and PCE readings, as these economic indicators could further influence the pair’s direction and gauge the strength of the dollar heading into the election period.

GBP/USD remain trading within its bearish trajectory but the bearish momentum is weakening. Should the pair trade above its resistance level at 1.3030, it may be seen as a solid trend reversal signal.

Resistance level: 1.2985, 1.3065

Support level: 1.2910, 1.2850

The EUR/USD pair briefly climbed above its recent high of 1.0826 but then pulled back by approximately 40 pips. If the pair can maintain support above its previous low, this could signal a potential trend reversal. This week, the Eurozone’s GDP and CPI data will be released, which are key indicators for traders to watch closely, as they could significantly impact the pair’s trajectory.

EUR/USD is seemingly easing from its bearish momentum, which may potentially trigger a technical rebound for the pair. The RSI has jumped out from the oversold zone, while the MACD is on the brink of breaking above the zero line, suggesting that the bearish momentum is easing.

Resistance level:1.0815, 1.0890

Support level: 1.0735, 1.0675

Japan’s recent election outcome, which saw Prime Minister Shigeru Ishiba’s coalition lose ground, introduces new challenges to the Bank of Japan’s potential shift toward a hawkish stance. With diminished political backing, Ishiba may struggle to implement more aggressive monetary policies, casting uncertainty over Japan’s economic strategy and likely reducing the BoJ’s capacity to move away from its dovish approach. This scenario is expected to exert downward pressure on the yen, reinforcing a bearish outlook as investors seek currencies backed by stronger rate hike prospects, such as the US dollar.

USD/JPY is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 82, suggesting the pair might enter overbought territory.

Resistance level: 153.25, 154.70

Support level: 151.65, 150.15

The Nasdaq briefly reached a three-month high, buoyed by mega-cap tech stocks, as the 10-year Treasury yield eased, providing favourable market conditions. This week, the tech-heavy index may experience heightened volatility, with heavyweight companies like Microsoft, Meta Platforms, and Amazon scheduled to release their earnings reports. These results are likely to have a direct influence on the Nasdaq’s movement.

Nasdaq is trading in a higher-high price pattern, suggesting a bullish bias for the index. The RSI remains above the 50 level, while the MACD is easing and dropping toward the zero line, suggesting that bullish momentum is easing.

Resistance level: 21075.00, 22040.00

Support level: 19705.00, 19120.00

The Australian dollar remains under pressure against its peers, as recent Chinese economic indicators fell short of market expectations, dampening demand for the Australian dollar, often seen as a proxy for Chinese economic activity. In addition to this, the Australian CPI report is due on Wednesday, with expectations of further easing inflation. If inflation continues to slow, it could place additional downward pressure on the Aussie dollar.

The AUD/USD pair failed to defend itself at the 0.6615 mark, suggesting a bearish signal. The RSI has been flowing below the 50 level, while the MACD edge lower suggests that bearish momentum is gaining.

Resistance level: 0.6615, 0.6675

Support level: 0.6550, 0.6490

Oil prices edged lower following Israel’s recent strike on Iran, which notably spared Tehran’s oil and nuclear facilities, alleviating immediate concerns over energy supply disruptions. The targeted nature of Israel’s strikes on missile factories and other strategic sites outside Iran’s oil infrastructure has raised cautious optimism for a potential de-escalation in the region. Investors should remain attentive to ongoing geopolitical developments, as further escalations or diplomatic efforts could impact oil prices in either direction.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bullish momentum, while RSI is at 36, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 69.90, 70.90

Support level: 67.10, 65.55

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!