Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

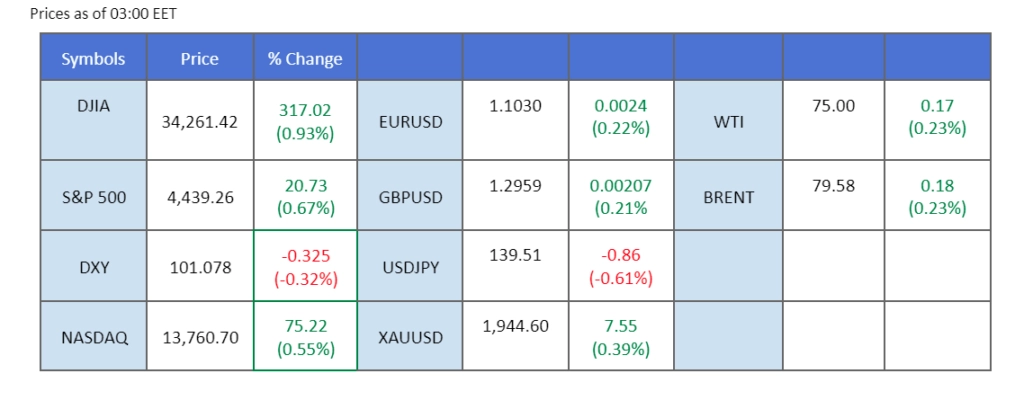

The Japanese Yen has reached its highest level in a month, surpassing the 140 mark against the U.S. dollar. This surge is attributed to the growing concerns of a global economic downturn due to major central banks tightening their monetary policies to combat persistent inflation. The Japanese Yen, known for its safe-haven status, has benefited from this situation. On the other hand, the U.S. dollar remains under pressure. At the same time, investors anticipate the release of the Consumer Price Index (CPI) later today, with expectations that U.S. inflation will show signs of easing. Elsewhere, oil prices continue to climb as Russian oil production declines and the market faces tightening supply conditions.

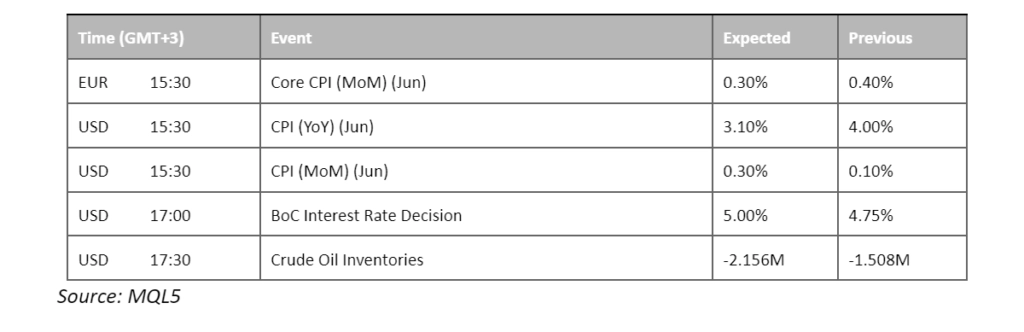

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (5%) VS 25 bps (95%)

The US Dollar faced significant downward pressure as investors grappled with disappointing US jobs data and a dovish stance from the Federal Reserve. Multiple members of the Monetary Policy Committee (MPC) indicated that the US central bank is nearing the conclusion of its policy tightening cycle. Investors are closely monitoring the release of inflation figures from the US region today, as these data points will provide key insights into the potential future movement of the US Dollar. Given the prevailing circumstances, the outcome of these figures will likely hold substantial significance for market participants.

The dollar index is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 26, suggesting the index might enter oversold territory.

Resistance level: 101.95, 102.50

Support level: 101.05, 100.25

As the US Dollar faces intense selling pressure due to the dovish tone from multiple Federal Reserve members, gold prices have witnessed a significant upswing, reaching a pivotal resistance level at $1940. Investors, seeking a safe haven amidst the uncertain market conditions, have flocked to gold, amplifying its demand. However, market participants should exercise caution as the gold market is expected to experience heightened volatility ahead of the crucial release of US CPI data later today.

Gold prices are trading higher following the prior breakout above the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 65, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 1950.00, 1970.00

Support level: 1930.00, 1910.00

The pair continued to trade higher and stayed above 1.100 psychological support level, signalling a bullish trend for the euro. The German CPI (MoM) that was released last night shows inflation in the country is still rising, which bolsters the euro to trade higher. On the other hand, the dollar’s strength continues to subside ahead of the release of the U.S. CPI. The market is expecting a softer CPI number which will lead to a more dovish monetary policy from the Fed and weaken the dollar as a result.

EUR/USD traded strongly and broke above its psychological resistance level at 1.100. The RSI constantly flows near the overbought zone while the MACD continues to climb, showing that the bullish momentum is still strong with the pair.

Resistance level: 1.1088, 1.1157

Support level: 1.0951, 1.0892

Cable rose to its 15-month high after solid U.K. jobs data was released and prompted the BoE to tighten their monetary policy to fight the sticky inflation. The U.K.’s CPI currently stands at 8.7% (YoY), which is one of the highest among its peers. On the other hand, the dollar continues to slide ahead of the U.S. CPI data is released. The market is expecting a softer CPI reading, and may hinder the Fed from imposing a tighter monetary policy.

The Cable is trading on a bullish momentum and is approaching another psychological resistance level at 1.3000. The RSI has once again broken into the overbought zone while the MACD is still gaining a strong bullish momentum with the Cable.

Resistance level: 1.2998, 1.3095

Support level: 1.2910, 1.2840

The Dow Jones Industrial Average eked out gains, bolstered by a robust rally in the energy and prominent technology sectors, while investors eagerly awaited crucial inflation reports set to be released later today. In the oil industry, mounting expectations are building that the market may witness a tightening during the second half of the year, supported by a notable decline in crude production and an encouraging economic outlook. In tandem, numerous members of the Federal Reserve unleashed dovish statements, affirming that the US central bank is nearing the culmination of its policy tightening cycle. This declaration prompted a further drop in US Treasury yields, thereby fueling market optimism towards the US equity market.

The Dow is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 57, suggesting the pair might extend gains toward resistance since the RSI stays above the midline.

Resistance level: 34445.00, 34895.00

Support level: 33700.00, 33260.00

The Reserve Bank of New Zealand (RBNZ) is poised to maintain its benchmark interest rate at 5.50%, which currently stands as the highest among developed nations, marking a departure from its nearly two-year streak of consecutive rate hikes. Despite market expectations of a dovish stance from the RBNZ, the New NZD/USD pair remains resilient, maintaining positive territory. This strength can be attributed to the substantial depreciation of the US Dollar. As for now, investors are advised to eye on the RBNZ interest decisions, which due later today for further trading signals.

NZD/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI ist at 61, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 0.6235, 0.6295

Support level: 0.6170, 0.6115

The oil market has witnessed a significant surge, primarily driven by the declining US Dollar and optimistic expectations of higher demand in the developing world. The US Energy Information Administration (EIA) has projected a rise in global oil demand from 99.4 million barrels per day (bpd) in 2022 to 101.2 million bpd in 2023. This upbeat demand forecast, coupled with the anticipation of a robust global economic recovery, has fueled market optimism and is likely to drive oil prices higher in the future.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 73, suggesting the commodity might enter overbought territory.

Resistance level: 76.65, 78.80

Support level: 70.30, 67.65

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!