Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

Pair trading is a versatile investment strategy that allows traders to take advantage of the relative price movements between two correlated financial assets. Whether you’re a beginner looking to understand the basics or an advanced trader seeking more sophisticated techniques, this comprehensive guide will walk you through the various aspects of pair trading and provide insights for success at different levels.

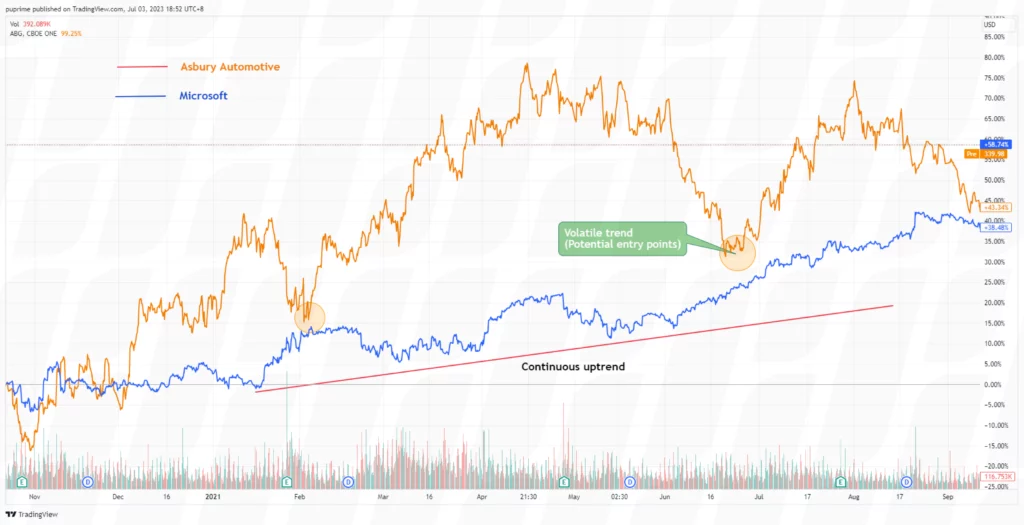

Pair trading is a popular trading strategy used by investors to take advantage of relative price movements between two correlated assets. It involves selecting a pair of assets that historically move together, such as two stocks from the same industry or two similar companies, and simultaneously taking long and short positions on these assets.

The basic idea behind pair trading is that even in a market downturn, if the two assets are highly correlated, their prices are likely to move in a similar manner. Therefore, by taking opposing positions (long on one asset and short on the other), the strategy aims to profit from the relative price movements between the two assets while minimizing exposure to broader market trends.

Price movements play a crucial role in pair trading, as they determine the profitability of trades and the potential for capturing market inefficiencies. Understanding the different scenarios that can occur in pair trading is essential for traders to identify opportunities and make informed decisions. In this section, we explore various types of price movements that traders may encounter when implementing pair trading strategies:

One common scenario in pair trading is when the prices of the two assets diverge significantly from their historical correlation. Traders can take advantage of this by establishing a pair trade strategy where they take a long position on the underperforming asset and a short position on the outperforming asset, expecting a reversion to the mean. As the prices revert back to their historical relationship, profits can be made.

Volatility-based pair trading strategies focus on taking advantage of changes in volatility between the paired assets. When one asset experiences a significant increase in volatility compared to the other, traders can adjust their positions to capture potential profits. By monitoring volatility levels and utilizing appropriate risk management techniques, traders can navigate these market conditions effectively.

Pair trading can also be employed around specific events or news announcements that affect the correlated assets differently. For instance, if a positive earnings announcement causes one stock to surge while the other remains relatively unaffected, traders can take advantage of this divergence by executing a pair trade strategy. By anticipating and reacting to such events, traders can capitalize on short-term price discrepancies.

Implementing a pair trading strategy successfully requires a systematic and well-executed approach. By following these guidelines and adopting a disciplined approach, traders can navigate the intricacies of pair trading and increase their chances of success:

The first step in implementing pair trading is selecting suitable pairs. Traders must identify assets that have a historically high correlation and exhibit a mean-reverting behavior. Through thorough analysis and research, traders can identify pairs that are likely to provide profitable trading opportunities.

Determining entry and exit points is crucial in pair trading. Traders use various indicators of technical analysis and fundamental analysis to identify optimal entry points when the price ratio between the paired assets deviates from its historical mean. Similarly, exit points are identified when the price ratio converges back to its mean or reaches predetermined profit targets.

Implementing effective risk management techniques is vital in pair trading. Traders employ strategies such as position sizing, stop-loss orders, and diversification to mitigate potential losses. Risk assessment and ongoing monitoring of positions help maintain a balanced portfolio and protect against adverse market movements.

Regularly monitoring the performance of pair trades is essential for evaluating the effectiveness of the strategy. Traders analyze metrics such as profit and loss, win rate, and drawdown to assess the profitability and consistency of their pair trading approach. Adjustments can be made based on performance analysis to optimize trading strategies over time.

Pair trading is a dynamic and versatile investment strategy that offers traders a range of opportunities beyond the basics. Here are some advanced techniques that can enhance trading outcomes and provide a competitive edge:

Statistical tools and modeling play a vital role in advanced pair trading strategies. By utilizing regression analysis, traders can identify and quantify the relationship between the price movements of paired assets. This statistical approach enables more accurate predictions and informed trading decisions. Additionally, advanced modeling techniques can provide insights into market behavior and aid in the development of robust trading strategies.

Cointegration analysis is a powerful statistical technique employed in advanced pair trading strategies. By examining the long-term equilibrium relationship between assets, traders can identify pairs that exhibit stable price relationships. Cointegration analysis helps identify pairs that may deviate temporarily but are likely to revert to their historical relationship, providing opportunities for profitable trades.

Pair trading is a dynamic and profitable strategy that caters to traders of all levels. Whether you’re a beginner seeking to grasp the fundamentals or an advanced trader looking to refine your approach, mastering pair trading can provide you with a valuable tool for navigating the financial markets. By understanding the basics, implementing the strategy effectively, and exploring advanced techniques, you can optimize your pair trading outcomes and achieve your financial goals.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!