Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

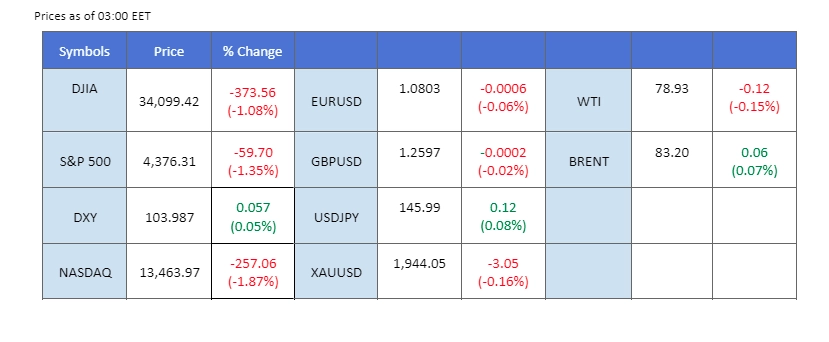

In anticipation of Jerome Powell’s address at the Jackson Hole Economic Symposium today, the dollar surged impressively by over 0.6% yesterday, propelling the dollar index to a current trading position above $104.00. This rise was amplified by the release of initial jobless claims data, which underscored the persistent tightness in the labour market. However, this upbeat dollar performance exerted downward pressure on gold prices, simultaneously leading to a decline in U.S. equity markets. Investors are speculating that the Federal Reserve might adopt a forceful monetary policy to effectively combat inflation. Meanwhile, oil prices remain buoyant, hovering near the $80 mark. This follows a report indicating a shortage in European oil stockpiles, specifically a 3% decline in storage within the Amsterdam-Rotterdam-Antwerp (ARA) region during the latest week.

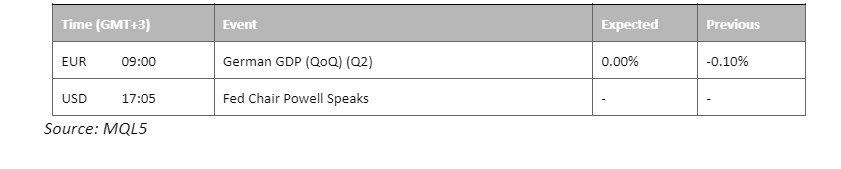

Current rate hike bets on 20th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS 25 bps (14%)

The US dollar orchestrated a resounding comeback, leveraging a wave of optimistic economic data. Anticipation swelled as the market eagerly awaited Fed Chair Jerome Powell’s potentially hawkish stance at the esteemed Jackson Hole Economic Policy Symposium. The Department of Labor report revealed an unforeseen drop in US Initial Jobless Claims, descending from 240K to 230K, surpassing the market’s modest prediction of 240K. In addition, the Census Bureau unveiled a robust surge in US Core Durable Goods Orders for the previous month, leaping from 0.20% to 0.50%.

The dollar index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the index might enter overbought territory.

Resistance level: 104.20, 105.75

Support level: 102.15, 100.75

Buoyed by rosier US economic data, gold prices underwent a mild retreat, reflecting a shift towards risk-on sentiment. Meanwhile, a mild resurgence in US Treasury yields found support from heightened prospects of a Fed-induced rate hike, anchored by a rosier economic outlook.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 60, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 1920.00, 1945.00

Support level: 1900.00, 1880.00

The dollar exhibited notable strength, advancing by over 0.6% yesterday to reach its highest point since June. This surge was catalysed by hawkish remarks from several Federal Reserve officials regarding the future of interest rates. These statements arrived just before Jerome Powell’s scheduled address at today’s Jackson Hole Economic Symposium. Furthermore, the recent job data released underscored the continued tightness within the U.S. labour market. This, in turn, offers the Federal Reserve more flexibility to consider raising interest rates. Adding to the market’s attention, the upcoming speech by the ECB chair at the same economic event is also closely monitored by investors with anticipation of insights into the strength and direction of the euro.

The EUR/USD has broken below its support level and exhibited a sluggish trend for the pair. The RSI flows closely to the oversold zone while the MACD moves downward, suggesting a bearish bias for the pair.

Resistance level: 1.0848, 1.0925

Support level: 1.0760, 1.0700

The Sterling faced a substantial decline of almost 1% yesterday, driven by a strengthening dollar. The dollar index has now reached a trading level above $104. This impressive rise in the dollar was fueled by hawkish statements from multiple Federal Reserve officials, who emphasised the potential for further rate hikes by the Fed. Contrastingly, the UK encountered a setback due to a PMI reading that fell short of expectations. This weaker economic data posed challenges for the Bank of England (BoE), hindering its ability to pursue an aggressive monetary policy, even though the country’s inflation rate remains notably distant from its targeted 2%. The BoE Deputy Governor speaking at the Jackson Hole Economic Symposium today is closely watched by investors to gauge the strength of the Sterling.

The Sterling has broken below its support level, adding that the RSI as well as the MACD declining, suggesting that the Sterling is trading in a bearish momentum.

Resistance level: 1.2640, 1.2780

Support level: 1.2540, 1.2460

The USD/JPY pair surged as US Treasury yields rebounded on the heels of robust US economic data. All eyes were on the Jackson Hole meeting for insights into global central banks’ monetary stances. Concurrently, China’s ban on Japanese seafood in the wake of the Fukushima wastewater issue added to trade tensions. The international response remained uncertain, possibly escalating sanctions and further weighing on the Japanese Yen.

USD/JPY is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the pair might enter overbought territory.

Resistance level: 146.40, 147.20

Support level: 145.60, 145.00

Major US equity indices relinquished ground, responding to the ascendant trajectory of US Treasury yields. The market was abuzz with speculation as investors positioned themselves for the potential hawkish undercurrents expected from the Federal Reserve’s Jackson Hole conclave.

Dow Jones is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum. However, RSI is at 29, suggesting the index might enter oversold territory.

Resistance level: 34460.00, 35605.00Support level: 33720.00, 32695.00

The oil market notched marginal gains as technical adjustments and strategic dip-buying took center stage. However, a cloud of uncertainty lingered as market participants braced for the potential impact of a hawkish speech from Powell, poised to bolster the dollar and dampen oil demand. In the midst of this, Saudi Arabia’s proposition of extending its production cut lent a minor lift to oil prices.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 43, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 79.15, 83.25

Support level: 76.90, 74.25

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!