Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

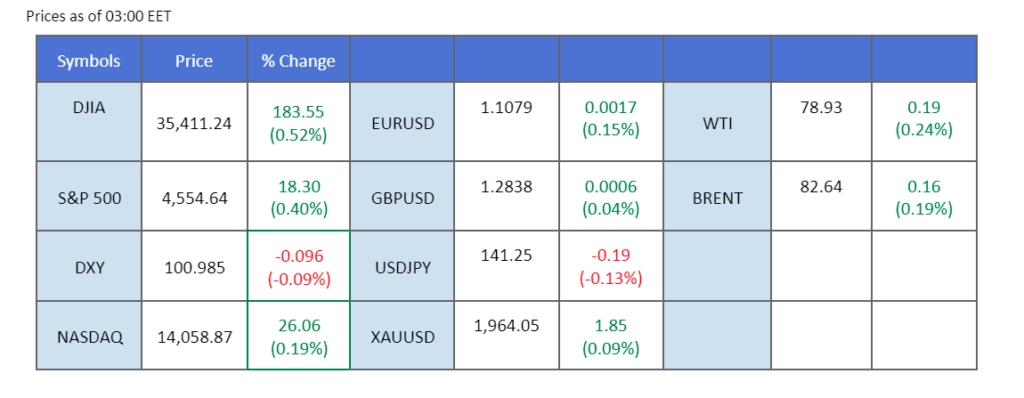

The Hang Seng Index and regional stock markets start the day with a solid 3% gap up, driven by a prevailing optimism over anticipated economic bolstering by the Chinese government. China’s top leaders unveiled plans for a large-scale stimulus package squarely aimed at revitalising the stagnating real estate sector while simultaneously fueling consumption. In tandem with these developments, oil prices soared to their highest levels since April, powered by the ripple effects of China’s robust economic growth measures and exacerbated by supply disruptions stemming from North American wildfires. Meanwhile, investors have a strong consensus, with expectations firmly aligned that the Bank of Japan (BoJ) will steadfastly maintain its ultra-loose monetary policy ahead of the Japanese central bank interest rate decision, scheduled to be revealed this Friday.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The US Dollar remains firmly on an upward trajectory against key currencies, including the Pound Sterling and Euro. Recent economic indicators highlight the US economy’s resilience compared to its counterparts in the United Kingdom and the European region. The Purchasing Managers’ Survey for July in the US region demonstrates superior performance when contrasted with similar surveys from Europe and the UK. Notably, the US S&P Global Composite PMI for July registered at 52.0, outperforming the S&P Global Composite PMI from the European region (48.9) and S&P Global/CIPS UK Composite PMI (50.7).

The dollar index is higher while currently testing the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the index might enter overbought territory.

Resistance level: 101.50, 102.05

Support level: 100.80, 99.65

Gold prices extend losses as investors embrace central bank monetary decisions. In anticipation of forthcoming monetary policy meetings from major central banks, including the Federal Reserve and European Central Bank, market participants expect potential interest rate hikes of 25 basis points. This sentiment prompts investors to reallocate their portfolios toward safer assets, such as treasury bonds, seeking enhanced risk-free returns. Banks have left room for interpretation, leading to sustained volatilities in the gold market.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 38 suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1980.00, 2000.00

Support level: 1950.00, 1930.00

The Euro faced a slump as lacklustre economic data emerged from the EU region, dampening market optimism regarding economic progress. Germany’s Manufacturing Purchasing Managers Index (PMI) fell to 38.8, missing market expectations and indicating the European Central Bank’s tightening monetary cycle has affected the manufacturing sector. Investors are advised to closely monitor the upcoming ECB interest rate decisions later this week for potential trading signals.

EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 55, suggesting the pair might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 1.1455, 1.1720

Support level: 1.1060, 1.0675

The Pound Sterling experienced a retreat amid a pessimistic economic outlook as the UK’s Manufacturing Purchasing Managers Index (PMI) dropped to 45.0, below market expectations. The decline in the PMI signals a more negative outlook for the UK economy, warranting investor attention to assess the potential impact on Sterling’s performance.

GBP/USD is trading lower while currently testing the support level. MACD has illustrated increasing bullish momentum, while RSI is at 39, suggesting the pair might be trading higher in short-term as the RSI rebounded sharply from oversold territory.

Resistance level: 1.2950, 1.3125

Support level: 1.2820, 1.2665

The Hang Seng Index (HSI) surged 3% at the opening bell following a significant commitment from China’s Polibuto to implement a large-scale economic stimulus package to revive the struggling real estate sector and bolster consumption in the country. The index had experienced lacklustre trading this year, partly attributed to disappointing economic data that was previously released, revealing a sluggish post-COVID economic recovery in China.

The HSI shows a sluggish trend with narrowing volatility, forming an asymmetric triangle pattern. The RSI has been flowing near the 50-level, and the MACD flows alongside the zero line with both indicators given a neutral signal.

Resistance level: 19700.00, 20850.00

Support level: 18750.00, 17830.00

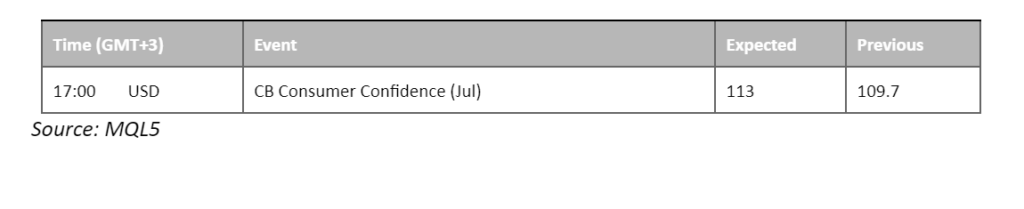

The dollar gained strength as the pair reached the 138.00 mark. Market focus is now on Wednesday’s Fed interest rate decision, with widespread expectations of a 25 bps increase. Investors will closely watch the CB Consumer Confidence data to gauge the Fed’s rate decision. Meanwhile, the BoJ’s interest rate decision is scheduled for Friday, and the market anticipates the Japanese central bank to keep its ultra-loose monetary policy, leading to a weakening of the Japanese Yen.

USD/JPY is trading in an up trend from its recent low at 138.00. The RSI has dropped out of the overbought but is hovering above the 50-level and the MACD is flowing above the zero line, suggesting the pair is still trading with bullish momentum.

Resistance level: 142.30, 145.00

Support level: 140.67, 139.40

Oil prices soar to near-three-month highs amidst supply constraints expected from OPEC+ soon. Furthermore, China’s commitment to bolster its post-Covid economic recovery contributes to an upswing in oil demand. Notably, China’s authorities have announced additional measures to support their economy, including bolstering the real estate sector and addressing government debt.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 74, suggesting the commodity might enter overbought territory.

Resistance level: 79.90, 82.35

Support level: 76.90, 74.25

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!