Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

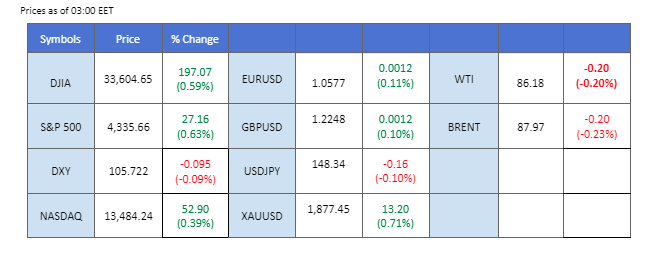

In a surprising turn, the dollar index lost its momentum following a markedly dovish tone from Federal Reserve officials, igniting widespread speculation that the central bank might maintain interest rates through 2023’s end. This sentiment shift occurred amidst rising Treasury yields and escalated tensions in the Middle East, discouraging the Fed from pursuing further monetary tightening measures. Meanwhile, the conflict between Hamas and Israel had a seismic impact on commodities: oil prices experienced their most significant surge since July, while gold prices saw a remarkable 1.6% overnight increase. Geopolitical events are reshaping market dynamics, prompting investors to reassess strategies in response to these unfolding global developments.

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (72.0%) VS 25 bps (28%)

The Dollar Index edged lower as traders brace for upcoming high-impact events, including US Consumer Price Index (CPI) and Producer Price Index (PPI) data, along with the release of Federal Open Market Committee (FOMC) meeting minutes. Market consensus suggests that recent monetary policy tightening may help stabilise US inflation figures, potentially leading to a US Dollar selloff.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the index might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 106.95, 108.65

Support level: 105.25, 103.15

The global financial landscape remains shrouded in geopolitical uncertainty, as risk appetite wavers amidst escalating tensions. Investors are navigating a delicate balance, with safe-haven assets like gold witnessing upward momentum in response to these mounting concerns.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 43, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 1885.00, 1945.00

Support level: 1835.00, 1785.00

The euro exhibits a robust trend reversal, bolstered by a softening dollar following the Federal Reserve’s notably dovish stance. The dollar index has dipped to October lows, influenced by soaring Treasury yields and escalating tension in the Middle East, prompting the Fed to reconsider its monetary tightening plans. Investors now anxiously await Thursday’s U.S. CPI data, a pivotal factor that could further influence the dollar’s strength.

The EUR/USD pair trend reversal has been getting more solid as the pair rebounded successfully before breaking below the 61.8% Fibonacci retracement level. The RSI and the MACD continue to flow upward, suggesting the bullish momentum is strong.

Resistance level: 1.0630, 1.0700

Support level: 1.0500, 1.0460

In response to the escalating Middle East tensions, the Japanese yen made a notable rebound, benefiting from risk-off sentiment. Market participants are closely monitoring the Bank of Japan’s potential intervention if the yen’s depreciation trend persists, prompting a realignment of investor focus towards the Japanese currency.

USD/JPY is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 35, suggesting the pair might extend its losses toward support level since the RSI stays below the midline.

Resistance level: 148.40, 149.95

Support level: 147.50, 146.25

The Dow Jones Industrial Average exhibited resilience, recovering from early-day weakness as investors seized the opportunity. This rebound comes in the backdrop of a cautious approach by Federal Reserve officials regarding interest rate hikes and growing apprehensions surrounding the Israel-Hamas conflict. The Israeli government’s decision to shut down energy fields has reverberated through financial markets, impacting defence and energy stocks positively. Additionally, US airlines faced headwinds due to flight suspensions to Israel and the ongoing rise in oil prices, which compounds fuel cost pressures for the industry.

The Dow is trading higher following the prior breakout above the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the index might extend its gains toward resistance level since the RSI rebounded sharply from oversold territory.

Resistance level: 33355.00, 34900.00

Support level: 33425.00, 32745.00

The British Pound advances, capitalising on a weakening dollar that market shifts toward U.S. Treasuries have prompted amidst escalating tension in the Middle East. Israel’s declaration of war against Hamas further intensifies global uncertainties. The dollar’s bullish momentum has also been curtailed by dovish remarks from Fed officials, setting the stage for a pivotal moment as markets await Thursday’s U.S. CPI data.

The Cable is trading firmly above its long-term downtrend channel, suggesting a solid trend reversal signal for the Cable. The RSI and the MACD are both moving upward suggesting the bullish momentum is forming.

Resistance level: 1.2370 , 1.2530

Support level: 1.2040, 1.1940

Oil prices are on an unrelenting upward trajectory, fueled by the escalating geopolitical tensions gripping the Middle East region. The spectre of potential disruptions in the oil supply chain looms large, igniting a fervent bullish momentum that shows no signs of abating. Investors and analysts alike are keeping a watchful eye on unfolding events in the Middle East, acutely aware of the profound impact these geopolitical forces can exert on oil prices and the broader economic landscape.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the commodity might extend its gains toward resistance leve l since the RSI stays above the midline.

Resistance level: 88.35, 91.50

Support level: 83.90, 80.35

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!