Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

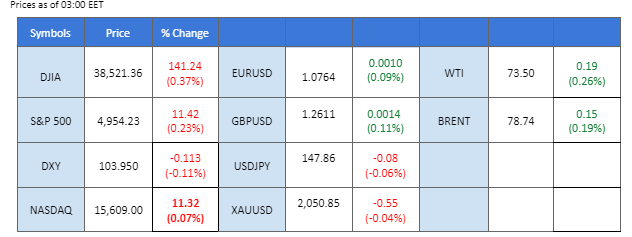

The Hang Seng Index has continued to show strength for the second consecutive session, with the Chinese government directing the China sovereign fund to provide support to the Chinese equity markets. In contrast, the U.S. equity market lacks clear direction amid perceptions of a prolonged monetary tightening policy from the Fed, as the economy remains robust, potentially leading to persistent inflation.

The U.S. dollar experienced a pullback after reaching its highest level in three months, coinciding with the struggling U.S. treasury yield. Meanwhile, commodities prices, including gold and oil, saw a technical rebound amid the easing strength of the dollar. Additionally, traders are eagerly awaiting the Chinese Consumer Price Index (CPI) and Producer Price Index (PPI) readings that are due tomorrow (08th Jan) to assess the condition of the Chinese economy, with potential direct impacts on oil prices and Chinese equity indexes.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (65%) VS -25 bps (35%)

(MT4 System Time)

Source: MQL5

The US dollar experienced a slight retreat following a notable ascent to its highest level in nearly three months. Strong economic data and a hawkish stance on interest rates from Federal Reserve officials bolstered demand for the dollar. However, the retracement primarily reflects technical corrections and profit-taking activities in the market. Market sentiments on rate cuts have shifted, with traders now pricing in a mere 19.5% chance of a cut in March, down from earlier expectations of 68.1% at the year’s outset. A positive US economic performance may delay rate cuts, bolstering the appeal of the dollar in the long term.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 53, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 104.60, 105.65

Support level: 103.85, 103.05

Gold prices stabilised after experiencing sharp declines in the past week, as the dollar’s rally paused for a technical correction. However, uncertainties linger regarding rising geopolitical tensions and the possibility of higher US interest rates, with markets even considering the Federal Reserve’s stance to remain static until June. Investors are advised to monitor gold’s resistance level at 2035, along with US economic data and geopolitical developments in the Middle East for trading signals.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2035.00, 2055.00

Support level: 2015.00, 1985.00

The GBP/USD has shown a robust technical rebound after experiencing a sharp plunge from its then-support level at 1.2610. The dollar had a pullback following the dollar index reaching its highest level in three months, allowing the Sterling to rebound from its recent low. However, the dollar is anticipated to continue trading in an uptrend trajectory as economic performance remains strong, and there are expectations that Fed officials will continue to express hawkish sentiments in their public speeches this week.

GBPUSD had a strong technical rebound from its recent low but is currently facing strong resistance at its previous support level of 1.2610. The RSI rebounded while the MACD crossed at the bottom, suggesting the bearish momentum is easing.

Resistance level: 1.2610, 1.2710

Support level:1.2520, 1.2440

The EUR/USD has experienced a slight rebound as the dollar eased from its recent bullish run. Yesterday’s release of German Factory Orders catalysed the euro to trade higher. The reading came in at 8.9%, significantly higher than the previous reading of 0%, indicating better-than-expected economic performance in Germany.

The EUR/USD had a technical rebound but is currently hindered by its then-downtrend support level. The MACD crossed at the bottom while the RSI rebounded before breaking into the oversold zone, suggesting the bearish momentum has eased slightly.

Resistance level: 1.0775, 1.0866

Support level: 1.0700, 1.0630

Chinese equity markets witnessed a remarkable rally, marking their most significant upturn in years. Sovereign wealth funds expressed their commitment to intensifying share purchases, responding to China’s ongoing stimulus measures aimed at bolstering the economy. This rally comes after a substantial $6.1 trillion market value erosion since the peak in February 2021. Central Huijin Investment, the equity arm of China Investment Corp, expanded its ETF holdings on mainland stock markets, supported by a statement from the China Securities Regulatory Commission endorsing such investment plans.

HK50 is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the index might extend its gains after it successfully breakout since the RSI stays above the midline.

Resistance level: 16270.00, 17180.00

Support level: 15485.00, 14945.00

The USD/JPY pair retraced from its strong resistance level at 148.75, a level where the pair had been rejected earlier in 2024. The dollar’s strength eased yesterday, in line with the decline in U.S. Treasury yields, which dropped below 4.10%. However, there is a belief that the dollar will continue to trade in a bullish trajectory, potentially putting pressure on the relatively lacklustre Japanese Yen.

The pair faced a strong resistance level at 148.75 and formed a triple-top price pattern. The RSI has fallen to near the 50 level while the MACD has crossed at the top, suggesting the bullish momentum has put a pause.

Resistance level: 148.67, 151.75

Support level: 146.75, 145.21

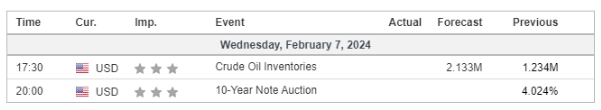

Crude oil prices rebounded, fueled by bullish inventory data. The American Petroleum Institute (API) reported a modest increase in US crude oil inventories, at 0.674 million barrels, falling below market expectations of 2.133 million barrels. This discrepancy, coupled with prospects of a slowdown in domestic output, boosted sentiment around crude oil.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 48, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 75.20, 78.65

Support level: 71.35, 68.35

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!