Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

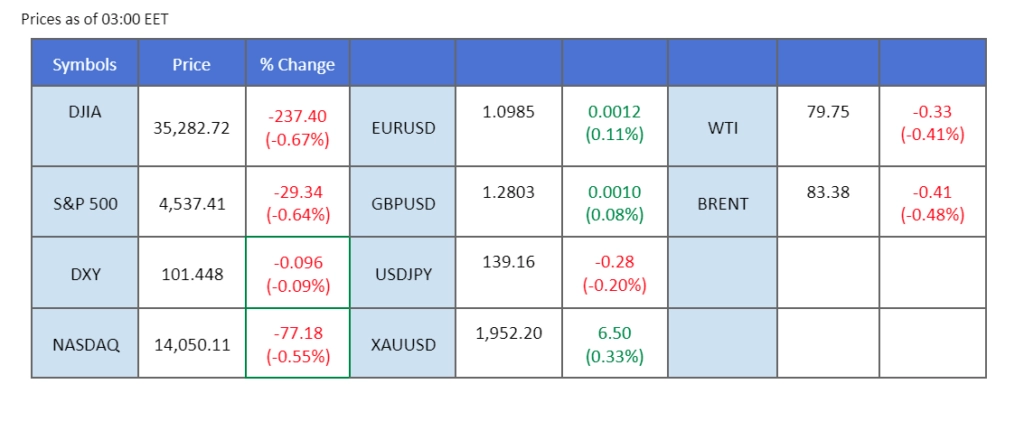

The Japanese yen displayed strength against its major counterparts last night. The market buzzed with speculation as the BoJ unveiled plans to discuss potential adjustments to its yield curve control (YCC) strategy. Speculators opine that the central bank may contemplate widening its YCC beyond the existing 0.5% cap, given the persistent inflationary pressures in Japan. In contrast, the U.S. dollar surged by 0.65% in response to upbeat economic indicators from the United States. Encouraging data, including GDP figures, job market data, and housing sales, underscored the resilience of the U.S. economy, elevating the DXY index. Meanwhile, the European Central Bank (ECB) raised its interest rate by 25 basis points, in line with market expectations. The ECB’s chair conveyed a data-dependent approach, leaving room for potential future rate hikes if warranted.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

-1024x365.webp)

The US Dollar gains strength against major currencies, propelled by a series of positive economic indicators, dampening expectations for a relatively dovish monetary policy from the Federal Reserve. Encouraging data, including better-than-expected Initial Jobless Claims, a significant uptick in Gross Domestic Product (GDP), and improved Pending Home Sales, boosts market confidence in the US economic momentum.

The dollar index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 101.95, 104.80

Support level: 99.05 94.95

Gold faces its sharpest one-day loss since late June, responding to a string of positive economic data from the United States. Market confidence in the US economy raises the likelihood of rate hikes, leading to a significant surge in the US Dollar.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1970.00, 1985.00

Support level: 1945.00, 1930.00

The European Central Bank announces a quarter percentage point rate increase, bringing its main rate to 3.75%. Despite declining inflation, the bank acknowledges inflation to remain higher than desired for an extended period. Questions arise about the impact of monetary policy on the region’s economic performance, as anticipation remains about the ECB’s long-term approach. Following the ECB’s rate hike announcement, the Euro experiences a decline amid uncertainties surrounding future monetary policy and concerns about potential economic recession in the region.

EUR/USD is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 1.1060, 1.1455

Support level: 1.0675, 1.0230

The U.S. dollar regained its strength and exhibited vigour against most major currency counterparts following the release of crucial economic data. With the U.S. GDP surpassing expectations and housing sales turning positive, coupled with a tight job market, the economic indicators suggested the resilience of the U.S. economy. Market speculation swirled around the possibility of a more hawkish monetary policy from the Fed in September. As a consequence, the AUD/USD pair took a significant plunge of more than 0.7%

The Aussie dollar was hammered by the strengthened U.S. for the 2nd consecutive session. The RSI is moving toward the oversold zone while the MACD is facing difficulties in breaking above the zero line suggesting the pair had a trend reversal

Resistance level: 0.6750, 0.6815

Support level: 0.6600, 0.6500

The cable witnessed a significant decline, erasing gains made in the past two sessions. The drop was primarily driven by the strengthening of the U.S. dollar following the release of vital U.S. economic data last night. The data underscored the resilience of the U.S. economy, leading to market speculation of a potentially more hawkish monetary policy from the Federal Reserve, given the yet-to-be-achieved 2% targeted inflation rate. Investors are closely monitoring upcoming events, including the U.K.’s PMI reading and the Bank of England’s interest rate decision, scheduled to be announced next week.

The strengthened dollar hammered GBP/USD and is currently trading below the resistance level at 1.2820. The RSI quickly declines to near the oversold zone while the MACD has crossed below the zero line, suggesting the previously held bullish momentum has vanished.

Resistance level: 1.2950, 1.3062

Support level: 1.2664, 1.2530

The Dow enjoyed an impressive 13-session winning streak until last night, marking its longest run of gains in years. The bullish trend was driven mainly by the Federal Reserve’s cautious approach to rate hikes, given the seemingly controlled inflation in the U.S. However, last night’s crucial U.S. economic data revealed a resilient economy, which may lead to a potential uptick in inflation. As a result, market sentiment is leaning towards a higher probability of the Federal Reserve continuing to raise rates in September, and there are speculations that the rate hike could be of a larger magnitude. Such prospects are not favouring the equity market.

The Dow closed lower last night but currently trades above its 100 SMA line. The RSI has dropped out of the overbought zone while the MACD has crossed above the zero line suggesting the bullish momentum for the Dow is diminishing.

Resistance level: 35440.00, 35850.00

Support level: 34930.00, 34520.00

In a dramatic display of market turbulence, the Japanese yen underwent a rapid fluctuation of one hundred pips immediately following the Bank of Japan Press Conference. The Monetary Policy Committee (MPC) opted for a notably reserved stance, refraining from providing substantial insight into its tightening monetary decision—a stark contrast to the earlier Nikkei report, which hinted at potential discussions surrounding a tweak to the Yield Curve Control (YCC) policy. This conflicting narrative ignited considerable uncertainty among investors, prompting a notable selloff in the Japanese yen.

USD/JPY is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 53, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 140.35, 141.25

Support level: 139.30, 137.60

Despite a notable appreciation of the US Dollar, oil prices continue to show a positive trajectory. Investors remain optimistic due to long-term fundamentals, anticipating supply tightness following OPEC+ production cuts. Additionally, positive economic outlooks from China, driven by new stimulus measures, and bullish US economic data contribute to the sustained future demand for oil.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 63, suggesting the commodity might be traded lower as technical correction since the RSI retraced sharply from overbought territory.

Resistance level: 79.90, 83.20

Support level: 77.30, 73.70

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!