Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

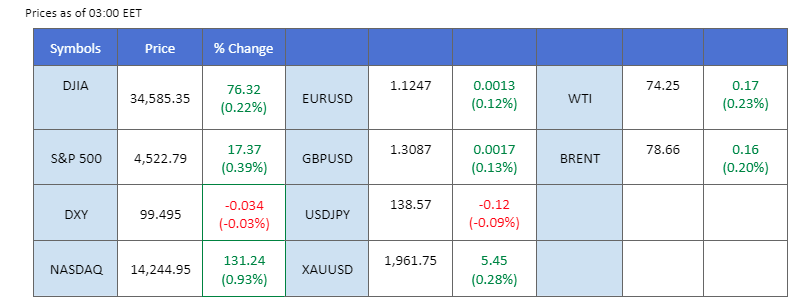

The financial market experienced a relatively calm session last night as investors awaited the release of U.S. retail sales data scheduled for later today (18th July). Major currency pairs remained stable, while gold prices traded within a narrow range of $1960 to $1940 since last Thursday. In the equity market, investor attention focused on the upcoming earnings reports as major U.S. indexes made modest gains, with the Nasdaq leading the way by recording nearly a 1% increase last night. Meanwhile, oil prices recovered slightly after a recent decline, which saw a 4% drop over the past two sessions. The announcement from Russia stating a reduction of third-quarter crude exports by 2.1 million tons and a decrease in overseas shipments by 500,000 barrels per day provided some support and lifted sentiment in the oil market.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (8%) VS 25 bps (92%)

.webp)

The US Dollar remained stagnant and exhibited a downward trend as US Treasury yields experienced a sharp decline. Slowing consumer and producer price indices in June fuelled expectations of a more dovish monetary policy from the Federal Reserve, prompting investors to reassess rate hike expectations. All eyes were on the upcoming release of US retail sales data for June, which was anticipated to be a pivotal economic indicator for the week.

The dollar index is lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 27, suggesting the index might enter oversold territory.

Resistance level: 101.45, 104.25

Support level: 98,70, 94.75

After experiencing significant volatility the previous week, the gold market traded flat as investors awaited further catalysts. Concerns arising from pessimistic economic data in both China and the United States slightly increased recession risks, prompting a shift in sentiment towards safe-haven assets like gold. Investors closely monitored economic outlooks and upcoming monetary policy decisions to assess the continued appeal of this precious metal.

Gold prices are trading flat while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 56, suggesting the commodity might be traded higher in short-term as technical correction since the RSI stays above the midline.

Resistance level: 1970.00, 1985.00

Support level: 1950.00, 1930.00

The euro receives ongoing support as the dollar’s strength continues to ease, allowing it to trade higher. Market consensus suggests that the European Central Bank (ECB) will implement an additional 25 basis points (bps) increase in interest rates next week, driven by the goal of achieving the targeted inflation rate. In line with this sentiment, ECB officials are making hawkish statements, indicating that the possibility of a monetary tightening policy will be discussed in the upcoming meeting. Moreover, there is a potential for further rate hikes in September, should the need arise. Investors are closely monitoring the Euro CPI data, as it will provide valuable insights into the future price movement of the euro.

EUR/USD traded strongly and is traded above the moving average line suggesting a bullish trend. The RSI is flowing in the overbought zone while the MACD has crossed above the zero line suggesting the bullish momentum is easing.

Resistance level: 1.1338, 1.1410

Support level: 1.1157, 1.1088

The sterling experienced a slight technical retracement as the dollar strengthened after the positive U.S. Empire manufacturing data release. Market participants are closely monitoring the U.K.’s Consumer Price Index (CPI) data, as they anticipate its potential impact on the GBP/USD currency pair. Meanwhile, the prevailing market consensus suggests that the Bank of England (BoE) will implement an additional 50 basis points (bps) increase in its interest rate in an effort to address the persistent inflationary pressures.

Cable’s bullish momentum has eased as the RSI has dropped out of the overbought zone while the MACD has crossed above the zero line depicting the bullish momentum has slowed down.

Resistance level: 1.3199, 1.3275

Support level: 1.3000, 1.2910

The Dow continues to hover around the crucial resistance level ahead of several crucial financial reports. Analysts predicted that corporate earnings would outperform forecasts, leading to a modest uptick in the US equity market. However, the gains were limited due to concerns stemming from pessimistic economic data from China. Investors kept a close watch on major US companies such as Tesla and Netflix, as well as banking giants like Bank of America, Morgan Stanley, and Goldman Sachs, which were expected to release their results following encouraging reports from JP Morgan.

The Dow is trading flat while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 65, suggesting the pair might extend its gains after successfully breakout above the resistance level.

Resistance level: 34615, 35395.00

Support level: 33700.00, 33260.00

The USD/JPY pair continues to trade flat in negative territory due to a lack of market catalysts from the US and Japan. However, market focus now turns to key economic indicators such as US retail sales, industrial production, and business inventories, which are set to be released today. These readings have the potential to influence market sentiment regarding the Federal Reserve’s monetary policy.

USD/JPY is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 36, suggesting the pair might be traded higher as technical correction since the RSI rebounded from its oversold territory.

Resistance level: 140.75, 144.50

Support level: 137.35, 134.05

Oil prices faced a significant retreat from their key resistance level as China’s gross domestic product (GDP) registered a mere 6.30% year-on-year increase in the second quarter, falling short of market expectations of 7.30%. This unexpected slowdown in the world’s largest oil consumer raised concerns about the strength of oil demand, triggering a downward spiral in prices. The downward pressure on oil prices intensified with the resumption of output at two out of three Libya fields, which had been shut down due to a protest following the abduction of a former finance minister.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 77.30, 79.75

Support level: 73.70, 70.30

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!