Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

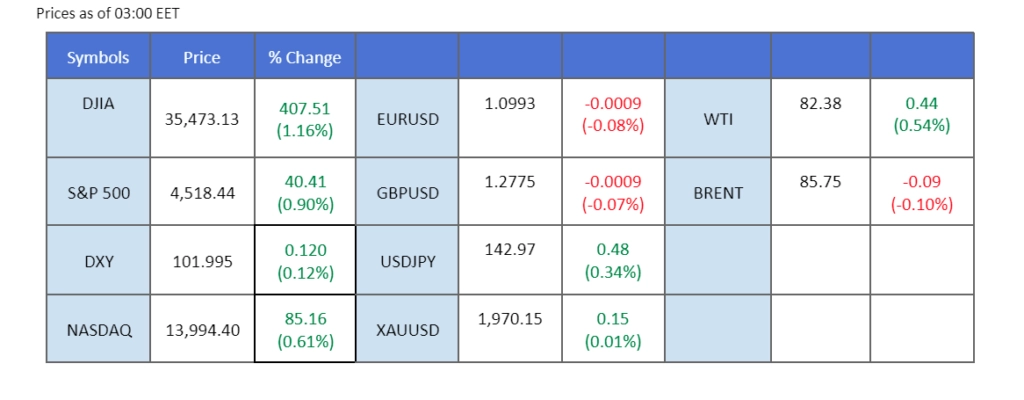

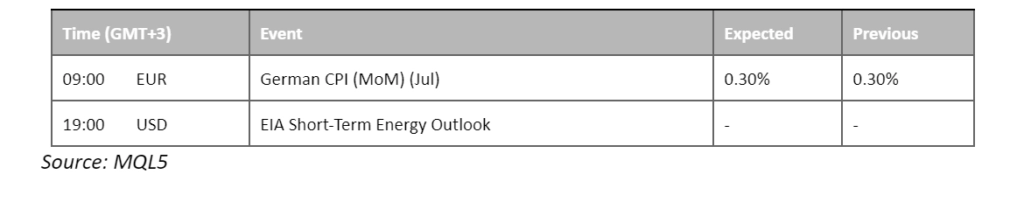

U.S. equity markets embraced a resurgence yesterday, effectively putting an end to their four-day losing spell. Notably, Warren Buffet’s Berkshire Hathaway reached an unprecedented pinnacle, while Amazon Inc. showcased an impressive climb of over 10% within the week. Simultaneously, the U.S. dollar maintained its bullish stance, marking a gain of 0.2% in the recent night’s trading session. Conversely, the realm of gold experienced a downtrend, with prices dipping below the $1940 threshold. In other developments, oil prices demonstrated steadfastness above the $82 mark, finding support in the backdrop of Saudi Arabia and Russia’s oil supply curbs. These deliberate actions overshadowed persistent concerns stemming from the global economic pessimism that has been casting a shadow. Elsewhere, Euro traders find themselves on the edge of anticipation as they eagerly await the unveiling of the German CPI scheduled for today to gauge the movement of the euro’s price.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The Dollar Index exhibited robust gains, bolstered by a series of resolute pronouncements from Federal Reserve officials. Federal Reserve Governor Michelle Bowman articulated her anticipation for further rate hikes to curb inflation and achieve the Fed’s coveted 2% target. Echoing her sentiment, New York Fed President John C. Williams, in an interview, emphasised the imperative for a sustained restrictive stance.

The dollar index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 51, suggesting the index might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 102.60, 103.40

Support level: 101.95, 101.55

Gold prices experienced a decline, attributed to the strengthening US Dollar. The resolutely hawkish tone maintained by Federal Reserve officials continued to erode the allure of this safe-haven asset.

Gold prices are trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 42, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1950.00, 1980.00

Support level: 1930.00, 1910.00

The Euro continues to grapple with resistance from the downtrend, a level it has been struggling against since mid-July, resulting in a prevailing bearish momentum. In contrast, the U.S. dollar has adopted a bullish stance, evident in the DXY index receiving support above the $102 mark.

Amidst this backdrop, Euro traders are in a state of anticipation, eagerly awaiting the release of the German Consumer Price Index (CPI). This key economic indicator will provide insights into the overall economic well-being within the Eurozone and offer valuable insights into the potential trajectory of the Euro’s valuation.

Euro continues to trade under its downtrend resistance level suggesting the pair is still trading in a downtrend manner. The RSI has moderated dropping out from the overbought zone while the MACD has stopped gaining near the zero line, suggesting the pair’s momentum is minimal.

Resistance level: 1.1090, 1.1150

Support level: 1.0930, 1.0850

The Pound Sterling extends its rally, as investors grapple with the repercussions of the hawkish monetary policy announced by the Bank of England (BoE) in the preceding week. The BoE, in its August policy meeting, elevated interest rates by 25 basis points to a 15-year pinnacle of 5.25%, up from the prior 5%. This resolute stance echoes the broader hawkish sentiment resonating across central banks.

GBP/USD is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 50, suggesting the pair might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.2815, 1.2990

Support level: 1.2655, 1.2500

The US equity market has commenced a rebound, with investors eagerly anticipating a wave of corporate earnings releases and pivotal inflation data. The corporate landscape enters the final stretch of the second-quarter earnings season, where an impressive 84% of S&P 500 constituents have already unveiled their financial results, with a substantial majority surpassing Wall Street’s expectations.

S&P 500 is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the index might extend its gains toward resistance level since the RSI rebounded sharply from oversold territory.

Resistance level: 4585.00, 4700.00

Support level: 4485.00, 4395.00

The Australian dollar remains locked in a sluggish performance against the U.S. dollar, attributed mainly to the recent strength of the dollar. This strength has been particularly pronounced in light of the recent downgrade of the U.S. credit rating. Simultaneously, China has released its trade data, revealing results falling short of expectations. This lacklustre economic recovery in China carries implications for the Australian dollar. Given that China stands as one of Australia’s foremost trade partners, its subdued economic performance is likely to cast a negative shadow over the trajectory of the Australian dollar.

The Aussie dollar is suppressed under the strong resistance level at 0.6600 and continues to trade downward. The RSI is still flowing below the 50-level while the MACD is moving toward the zero line suggesting a mixed signal for the pair.

Resistance level: 0.6600, 0.6680

Support level: 0.6500, 0.6390

Oil prices continue their bullish trajectory, underpinned by an alignment of robust fundamental factors. Anticipation remains widespread among investors regarding imminent OPEC+ production cuts, coupled with a nascent global economic recovery that augments the outlook for heightened oil demand. Investors remain poised to scrutinise forthcoming economic data, particularly focusing on inflation figures from the US and China, seeking additional trading cues.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the commodity might be traded lower as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 83.20, 87.25

Support level: 79.90, 76.90

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!