Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

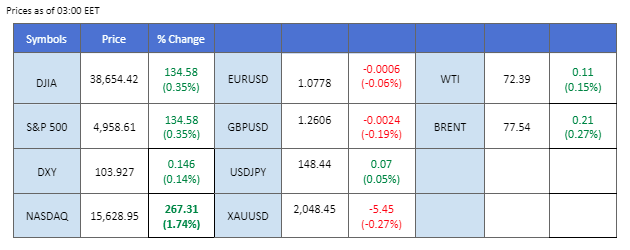

The robust U.S. Nonfarm Payroll report released last Friday, with a reading of 353k, higher than the previous 333k, has significantly impacted the market. The data suggests that the U.S. labour market remains strong. In response, the dollar experienced a notable gain of nearly 1%, affecting commodity prices such as gold and oil, which were adversely affected by the strengthened dollar.

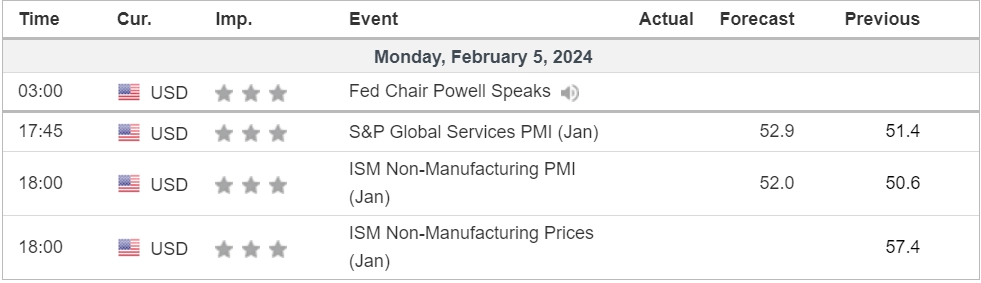

In a TV interview, Federal Reserve Chair Jerome Powell indicated that the likelihood of an interest rate cut may need to wait beyond March. Powell emphasised that the central bank is awaiting more evidence to confirm that the inflation rate in the country is heading down to a sustainable 2%.

Looking ahead, the Reserve Bank of Australia is expected to announce its interest rate decision on February 6th. It is anticipated that the Australian central bank will maintain its interest rate at a decade-high level to balance pricing risks and recession risks. The decisions and statements from these central banks continue to shape market dynamics.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (65%) VS -25 bps (35%)

(MT4 System Time)

Source: MQL5

The Dollar Index sees a robust surge, reaching a seven-week high following better-than-expected US jobs data, reinforcing the resilience of the US job sector. The Department of Labor reports a significant increase of 353,000 in Nonfarm Payrolls, surpassing market expectations of 180,000. The positive figures for Average Hourly Earnings and Unemployment rate further reduce the likelihood of imminent Federal Reserve interest rate cuts, with the CME FedWatch Tool indicating a mere 21% probability for a March rate cut, down from 38% last week.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 65, suggesting the index might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 104.60, 105.60

Support level: 103.85, 103.05

Gold prices experience a sharp decline as a robust jobs report raises the odds of the Federal Reserve maintaining its high-interest rate policy in the long term. The diminishing appeal for dollar-denominated gold reflects shifting expectations, with the overall prospect for the gold market trending toward a more bearish outlook in a higher interest rate environment.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 47, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2055.00, 2080.00

Support level: 2030.00, 2015.00

The GBP/USD experienced a sharp decline last Friday as the U.S. Dollar strengthened on the back of upbeat economic data. The Nonfarm Payroll report exceeded the previous reading, and the Unemployment rate remained steady at 3.7%. This led the market to believe that the Federal Reserve might be inclined to maintain elevated interest rates for an extended period. The interplay of economic indicators continues to influence currency movements, shaping market sentiments and expectations.

GBPUSD recorded a sharp decline but remains trading within its wide sideway range. The RSI is approaching the oversold zone while the MACD is moving lower, suggesting a bearish momentum might be forming.

Resistance level: 1.2710, 1.2785

Support level:1.2528, 1.2437

The EUR/USD pair reached its lowest level in 2024 as the U.S. Dollar strengthened on the back of upbeat economic data. As indicated by recent economic data, the comparatively lacklustre economic performance of the euro continues to exert pressure on the currency, causing it to trade weakly against its peers.

The EUR/USD traded to its lowest level in mid-December, forming a bearish expanding triangle pattern. The RSI hovering near the oversold zone while the MACD is moving lower suggests a bearish momentum is forming.

Resistance level: 1.0866, 1.0954

Support level: 1.0700, 1.0630

Despite increasing US Treasury yields, the US equity market continues its bullish trend fueled by better-than-expected corporate reports. Meta Platforms surges by 20%, and Amazon sees an 8% increase after releasing financial reports that exceed expectations. The stellar performance of these major tech corporations sparks optimism in the broader US equity market.

Dow Jones extended its gains after it successfully breakout above the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 69, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 39230.00, 40000.00

Support level: 37755.00, 36600.00

The USD/JPY pair is currently trading at its highest levels since November, reflecting the ongoing strength of the U.S. Dollar. Despite geopolitical tensions and concerns about China’s economic challenges, usually seen as tailwinds for the safe-haven Japanese Yen, the dollar has remained robust. The pair’s recent surge is attributed to the combination of an upbeat Nonfarm Payroll (NFP) reading and a hawkish statement made by the Federal Reserve’s chair during a television interview. These factors have propelled the USD/JPY pair to trade near the 149 level.

The pair is on the brink of breaking above its strong resistance level at near 149. The RSI is on the verge of breaking into the overbought zone while the MACD is breaking above the zero line, suggesting the bullish momentum is strong.

Resistance level: 148.67, 151.75

Support level: 146.75, 145.21

Crude oil prices extend losses as optimism grows over an extended ceasefire in the Israel-Hamas conflict, alleviating concerns about oil supply disruptions. Reports of Israeli and Hamas leaders considering a ceasefire contribute to a de-escalation in Middle East tensions. Additionally, a strengthening US Dollar and rising yields weigh on the black commodity.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 75.20, 78.65

Support level: 72.05, 69.85

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!