Pobierz aplikację

-

- Platformy handlowe

- Aplikacja PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Warunki Handlowe

- Typy kont

- Spready, Koszty i Swap

- Depozyty i Wypłaty

- Opłaty i Koszty

- Godziny Handlu

Pobierz aplikację

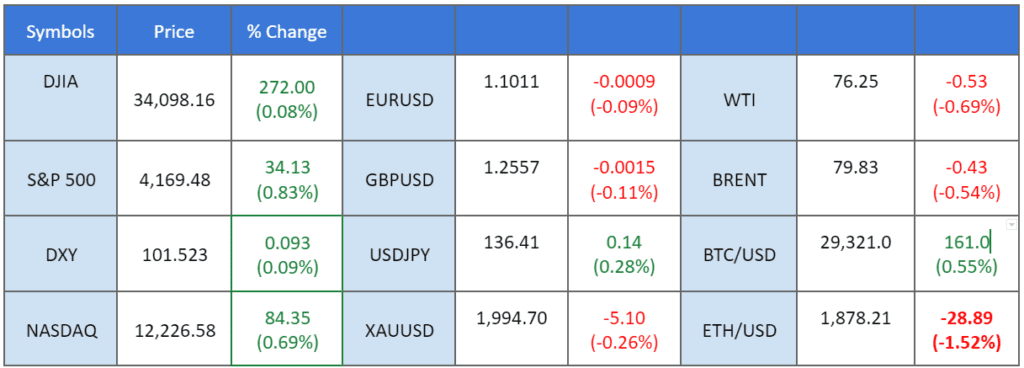

Wall Street’s gained at the end of last week as investors waited for news on a bid for First Republic Bank. Japanese and Australian stocks edged higher, while U.S. futures were broadly flat in early Asian trading after the S&P 500 rose 0.8% on Friday, posting back-to-back monthly gains for the first time in five months. The CBOE Volatility Index fell below 16 points for the first time since November 2021. The future of First Republic Bank weighed on markets, with regulators having asked banks to submit bids for the embattled lender by midday Sunday. Interest rate decisions by the Federal Reserve, the European Central Bank, and the Reserve Bank of Australia will be in focus this week.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (14.8%) VS 25 bps (85.2%)

Prices as of 03:00 EET

The U.S. dollar held steady before the expected rate hike and positive jobs report, supported by rising consumer sentiment and the modest increase in the PCE price index in March, which suggests a possible moderation in inflation growth. The University of Michigan Consumer Sentiment data for April showed a rise in consumers’ one-year inflation outlook to 4.6%, boosting the dollar’s gains and further supporting expectations of a rate hike. The FedWatch tool indicates an 81.5% probability of a 25 basis-point rate hike at the upcoming Federal Reserve meeting.

The Dollar Index is currently hovering around the support level. MACD has indicated a neutral to bullish momentum, while the RSI is at 53, indicating that the index is also trading with a neutral to bullish momentum.

Resistance level: 103.15, 105.25

Support level: 101.25, 99.10

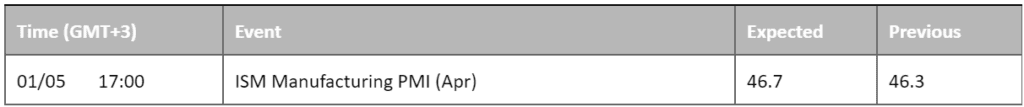

Gold prices remained relatively stable and traded in a narrow range as investors eagerly await the upcoming Federal Reserve interest rate decision on Wednesday. The market closely watches the decision for clues on future monetary policy and its potential economic impact. With mixed economic data being released, investors will likely wait to make any major moves until they have more information. Additionally, investors will monitor the market conditions to determine how they may affect the price of gold.

Gold prices continue to trade in a relatively tight range below the critical psychological level of $2000. The MACD line is hovering around the zero level, signalling that traders remain cautious and subdued in the current market conditions. Additionally, the RSI is currently at 46, indicating that investors are waiting for a clear outlook before making any further significant directional moves. Many are anticipating the upcoming Federal Reserve interest rate decision scheduled for Wednesday, which will impact gold prices significantly.

Resistance level: 2000.00, 2025.00

Support level: 1975.00, 1945.00

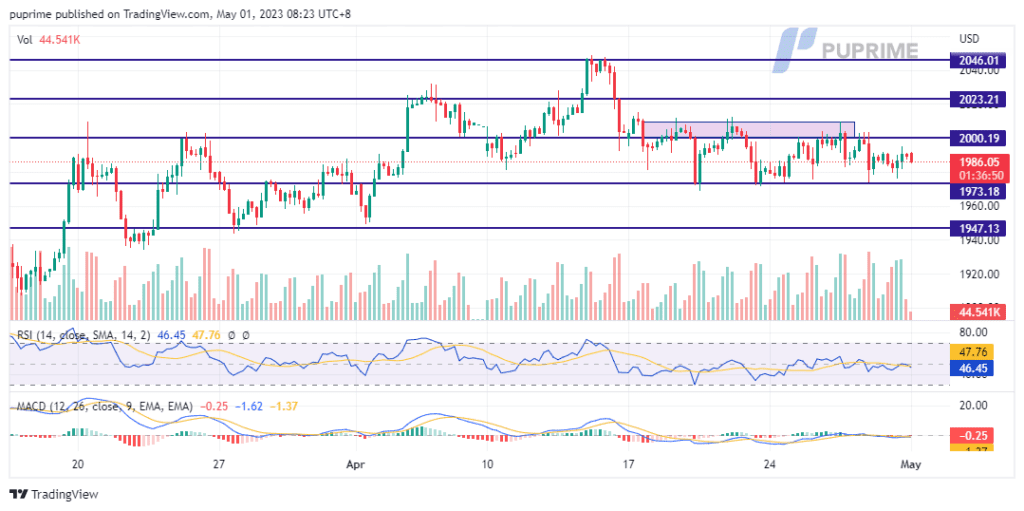

The euro weakened by 0.25% against the dollar to $1.1005 amid mixed economic data that created uncertainty over the European Central Bank’s expected interest rate hike next week. Preliminary data revealed that gross domestic product in the eurozone expanded by 0.1% in the first quarter, falling short of expectations in a Reuters poll for 0.2%. However, the European currency recovered some losses as investors sold the yen against the euro, spilling over to the euro/dollar cross.

The euro has the potential to break above its one-year high of $1.1095 if the bullish momentum continues. The MACD indicator trades above the zero line, indicating a neutral to bullish trend. The RSI indicator currently stands at 48, which suggests a neutral to bullish momentum. Investors are advised to closely monitor the upcoming ECB rate hike decision, as it will likely significantly impact the currency’s future trading movements.

Resistance level: 1.1075, 1.1168

Support level: 1.0924, 1.0790

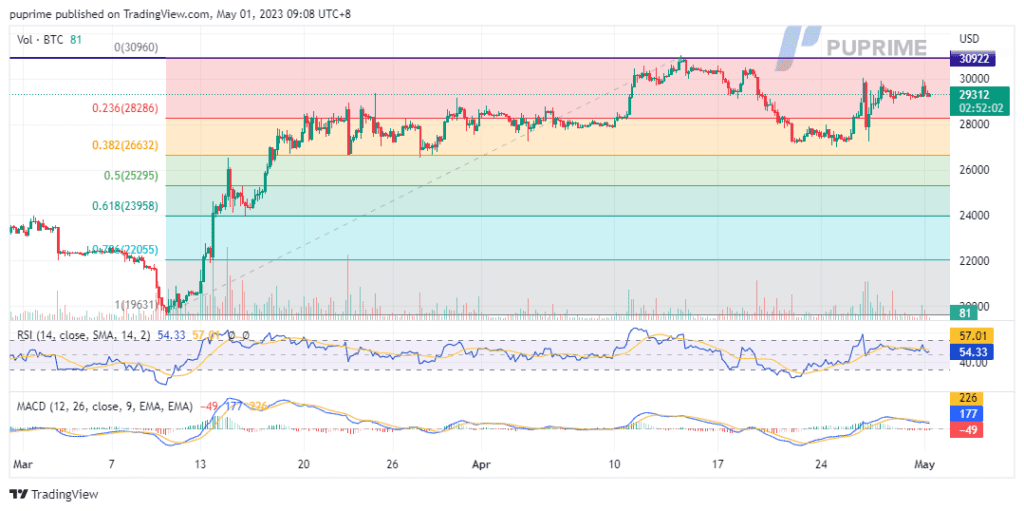

Bitcoin is on track to record its fourth consecutive monthly gain, its longest winning streak since March 2021. Data compiled by Bloomberg suggests that four-month winning runs in Bitcoin are followed by an average surge of 260% over the next year. Analysts have suggested various price targets for Bitcoin, with some saying it could hit $105,000 or even $160,000 if it approaches 25% of gold’s market capitalization. However, the cryptocurrency market remains exposed to risks such as regulatory crackdowns and changes in Fed policy. Despite this, the crypto market continues to attract new investors and expand to new investing cohorts. Hong Kong’s round-table meeting with banking and virtual-asset service providers signals a growing interest in the crypto industry, including discussions on the banking needs of non-licensed firms in the web3 sector.

Bitcoin is currently undergoing multiple tests of the $30,000 level, prompting traders to remain vigilant for any potential breakout. The MACD is signalling an increasingly bullish momentum, while the RSI stands at 53, also pointing towards an optimistic outlook.

Resistance level: 30960, 34721

Support level: 28285, 26630

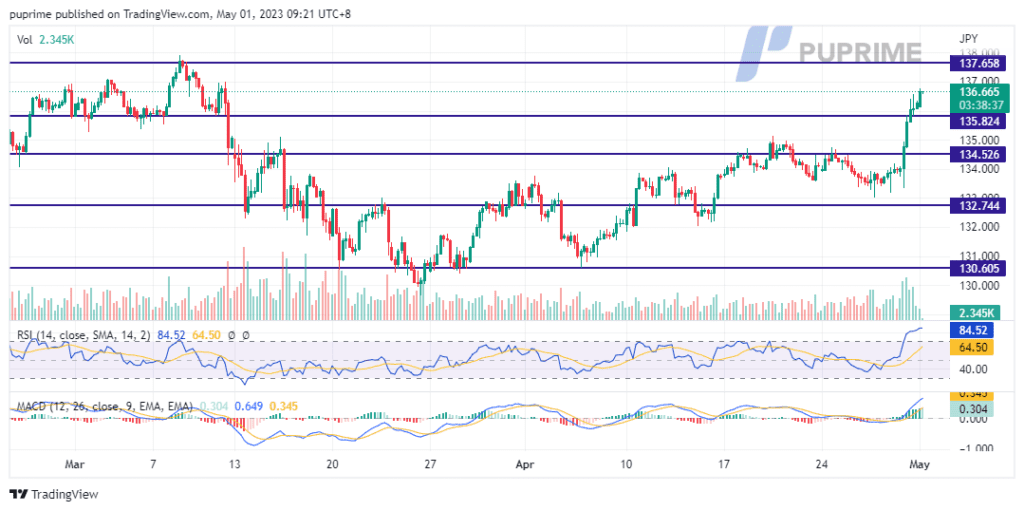

The Bank of Japan’s decision to maintain ultra-low interest rates and yield curve control policy, as expected, resulted in the yen falling to its weakest level since 2008. BOJ Governor Kazuo Ueda’s indication of a more flexible stance on policy while keeping stimulus measures unchanged disappointed traders betting on a hawkish shift. The BOJ also announced a policy review of monetary easing measures, which may take up to 18 months to report. Faster-than-expected inflation readings and lower growth forecasts by the central bank are causing concerns about stagflation among some investors.

The currency pair has surged to $136.66 as of writing, while the MACD chart indicates a progressively bullish trend. However, the RSI has climbed to 84, breaching the overbought zone, which suggests that the pair may require a technical retracement before further upward momentum can be sustained.

Resistance level: 137.65, 140.00

Support level: 135.82, 134.52

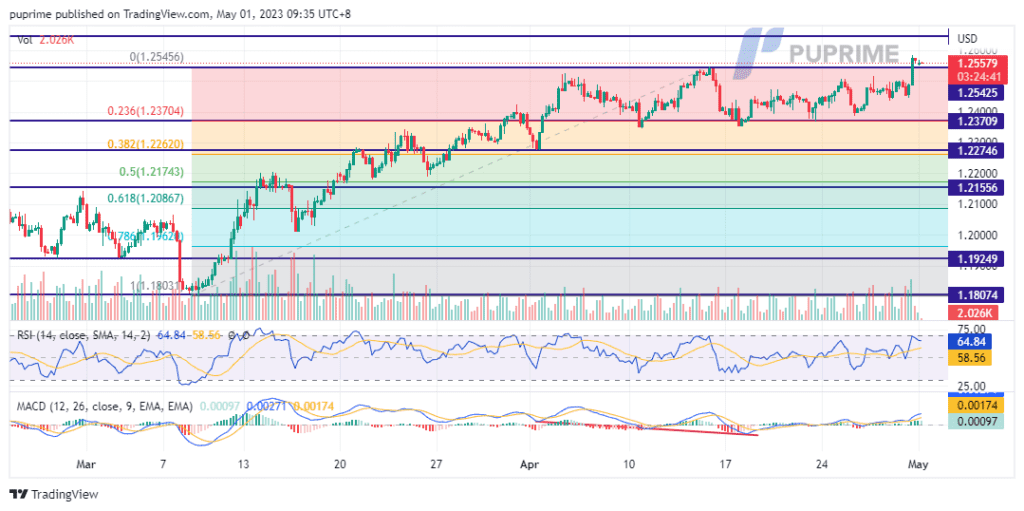

On Friday, the pound climbed 0.89% against the dollar to reach $1.2559. The pound strengthened, and the British stock market received a boost from rising energy stocks. However, data revealed that Britain was the only country in Western Europe in March to experience double-digit inflation, leading some market players to anticipate more economic struggles unless the Bank of England curb inflation and boost growth. The central bank’s upcoming rate-setting meeting on May 11 is closely watched for any signals or decisions that could impact the country’s economic outlook.

The pound continues to exhibit strength, breaking its 11-month high and reaching $1.2583 against the dollar on Friday. The MACD indicator highlights the current bullish momentum, and the RSI reading of 63 suggests a favourable trend for the currency.

Resistance level: 1.2645, 1.2774

Support level: 1.2545, 1.2370

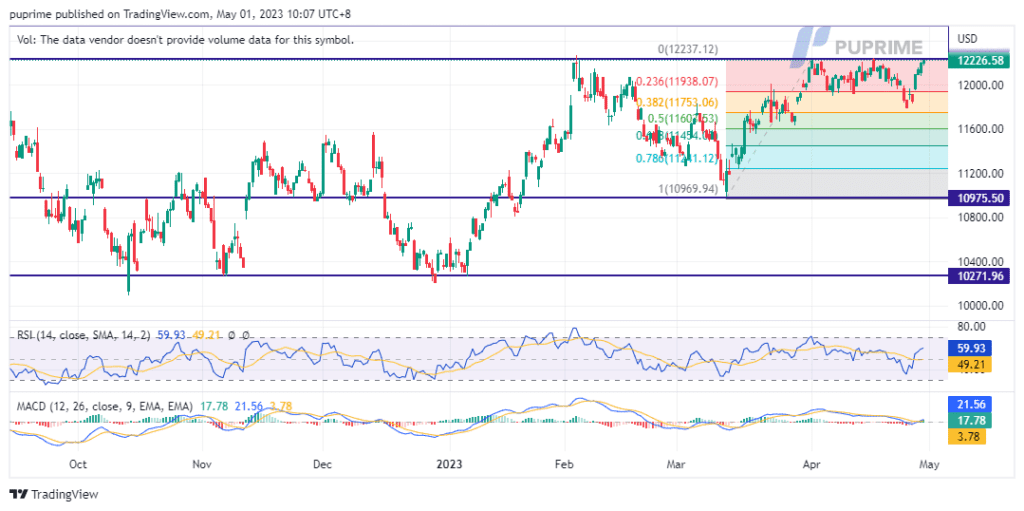

The Nasdaq Composite index added 0.69% to 12,226 points on Friday. The gain was mainly driven by robust earnings reports from Intel and Exxon, offsetting concerns from Amazon’s slowdown warning. The overall earnings season was better than expected, beating the pessimistic predictions. However, investors remain cautious ahead of the upcoming earnings report from tech giant Apple and the highly anticipated April job report and FOMC meeting. Analysts suggest that the outcome of these events could significantly impact the Nasdaq Composite index.

The index shows signs of a potential breakthrough of its resistance level at 12233, as it has been testing it again. The MACD indicator suggests a bullish momentum, while the RSI at 58 indicates a bullish trend shortly. It has led investors to speculate that the index may soon see a significant rise in value.

Resistance level: 12233, 12536

Support level: 11938, 11753

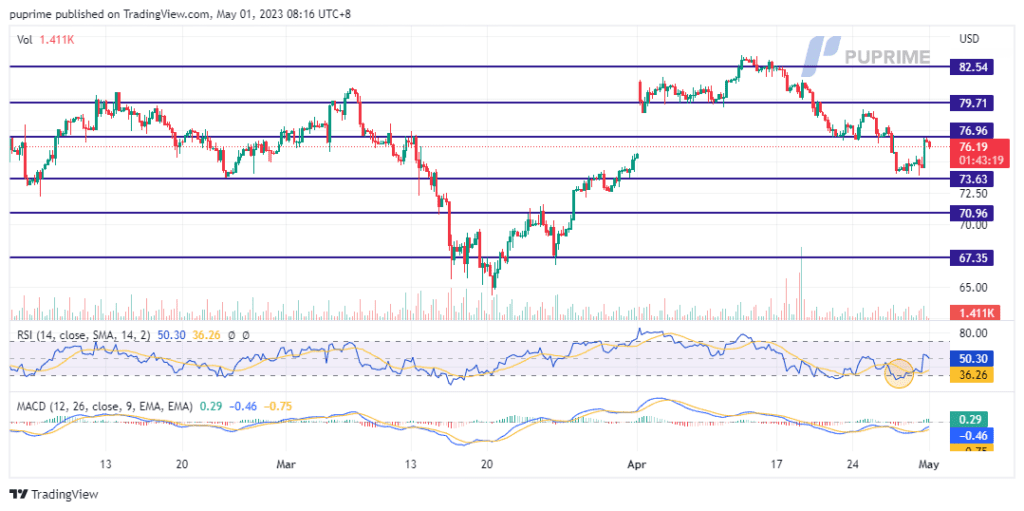

Oil prices have risen as China’s mixed economic data raises concerns about the country’s economic recovery. China’s manufacturing PMI contracted in April, with sub-indexes for new orders, new export orders, and manufacturing employment all below the 50 mark. However, data from the non-manufacturing activity index showed strong expansion in the services and construction sectors due to rising consumer spending and government expenditure. Furthermore, China’s Labor Day holiday also saw a strong recovery in consumption, with record railway trips made on the first day of the break and major retail and catering companies seeing a 21% increase in sales from a year ago.

Oil prices have risen to their resistance level, supported by a weakening bearish momentum according to the MACD indicator. Meanwhile, the RSI has increased from 34 to 50, indicating a more neutral sentiment in the market.

Resistance level: 76.95, 79.70

Support level: 73.75, 70.95

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Zarejestruj się na Live Account w PU Prime za pomocą naszego procesu bez żadnych kłopotów.

Bez wysiłku doładuj swoje konto za pomocą szerokiego zakresu kanałów i akceptowanych walut.

Uzyskaj dostęp do setek instrumentów w ramach wiodących na rynku warunków handlu

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!